In recent decades, technology has rapidly evolved, bringing significant changes to our lives and investments. From electronic circuits to cloud computing, each advancement has shaped our world. Now, in the 2020s, artificial intelligence (AI) is taking center stage, with big companies heavily investing in it.

As we continue our series on Artificial Intelligence (AI), we want to next touch on the investment implications around this rapidly evolving technology. Capital investments are being made across numerous industries with a wide range of companies expected to benefit from the growth in this technology.

In our previous article, How AI Will Change our Jobs and Economy, we explored the possible economic impacts and changes in the labor force resulting from the adoption of AI. In this article we will drill down into several of the companies driving the development and delivery of AI technology along with the high expectations priced into these stocks.

The Evolution of Technology and the Rise of AI

Over just the last generation, society has undergone several transformative technological advancements from the integrated electronic circuit in the 1970s to the personal computer in the 1980s, the internet in the 1990s and mobile and cloud computing in the 2000s and 2010s. Each breakthrough was built on previous advancements and changed the investment landscape along with our daily lives.

As we step into the 2020s, generative artificial intelligence appears poised to be the defining story of this decade. In addition, cloud computing providers (who deliver computing services such as servers, storage databases, networking, software, analytics and more over the internet, often referred to as “The Cloud”) will likely see further growth this decade driven by a surge in data and the adoption of emerging AI technology.

Given the vast potential of AI, it’s no surprise a handful of technology stocks have soared in price since ChatGPT captured the public’s attention earlier this year. While the capital investment numbers are huge, and estimates vary widely, it appears this could be the start of the next megacycle for the technology sector.

The “Magnificent Seven Stocks” – Amazon, Apple, Google parent Alphabet, Meta Platforms, Microsoft, Nvidia, and Tesla – are fueling a new market rally with year-to-date returns ranging from 40% – 230%, as compared to the S&P 500 index gain of 15%. All these mega cap stocks have been big winners in 2023 and investing heavily in AI technology. The Magnificent Seven represented nearly the entirety (~92%) of the S&P 500’s performance year-to-date. These stocks are “priced for perfection” and vulnerable to sharp declines if they do not deliver outpaced revenue and earnings projections for 2024.

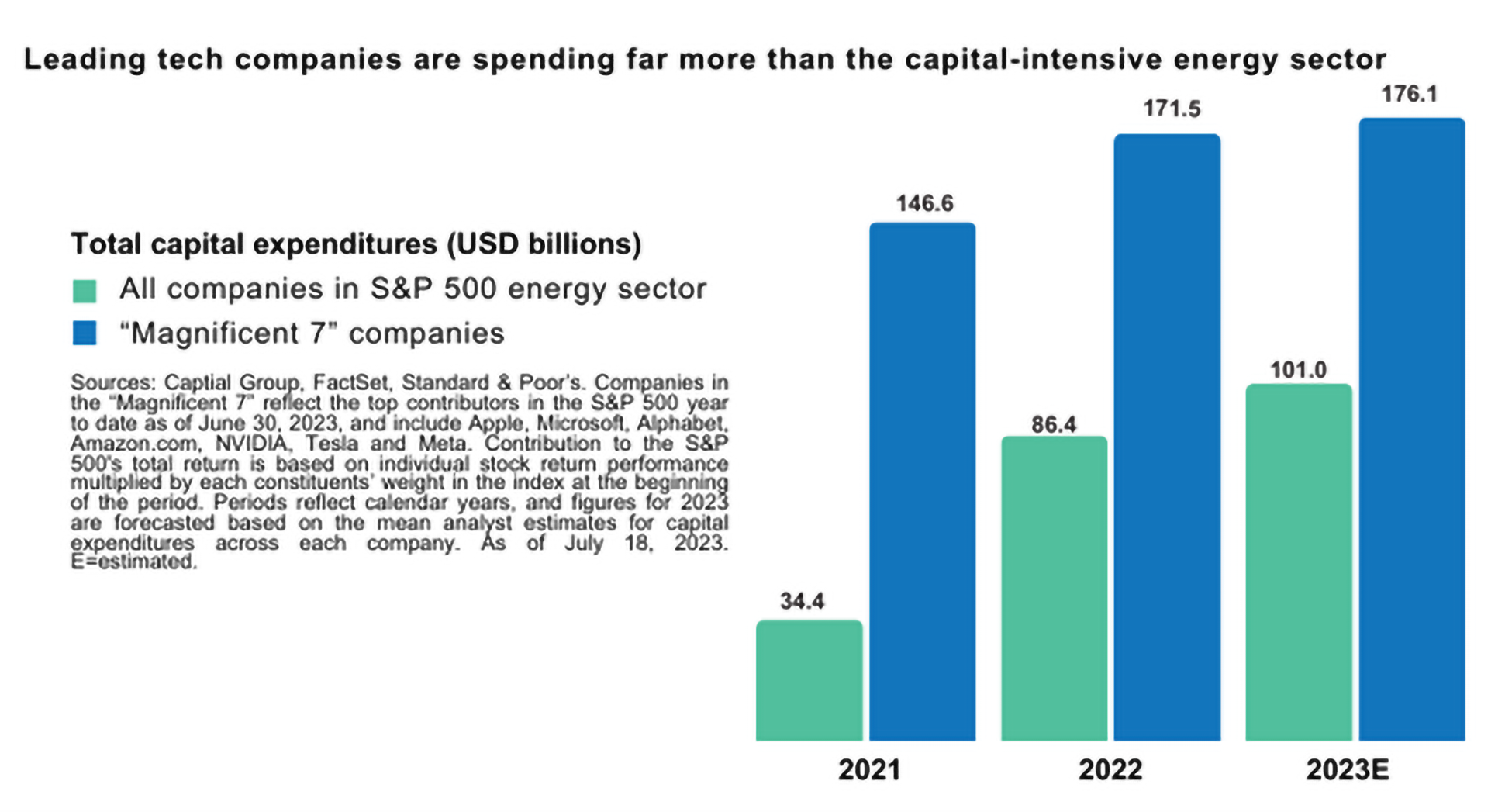

The seven leading tech companies as of the first half of this year are spending far more in capital investments as compared to the entire capital-intensive energy sector of the S&P 500 as shown in the chart below:

But returns on these investments won’t be linear, as we have already seen this year. Stock prices will likely go through fits and starts, with stocks getting overextended at times and pulling back when the market doubts progress. So, while we are interested in keeping an eye on potential benefactors of the AI trend, we are not necessarily recommending overweighting any company or sector. We should note the “Magnificent Seven Stocks” are the largest seven holdings in the widely held Vanguard Total Stock Market ETF (comprising 22% of this fund) and the Vanguard Growth ETF (comprising 50% of this fund). While the average investor may feel like they are missing out, most actually hold substantial positions in all seven of these stocks through these and other passive index funds.

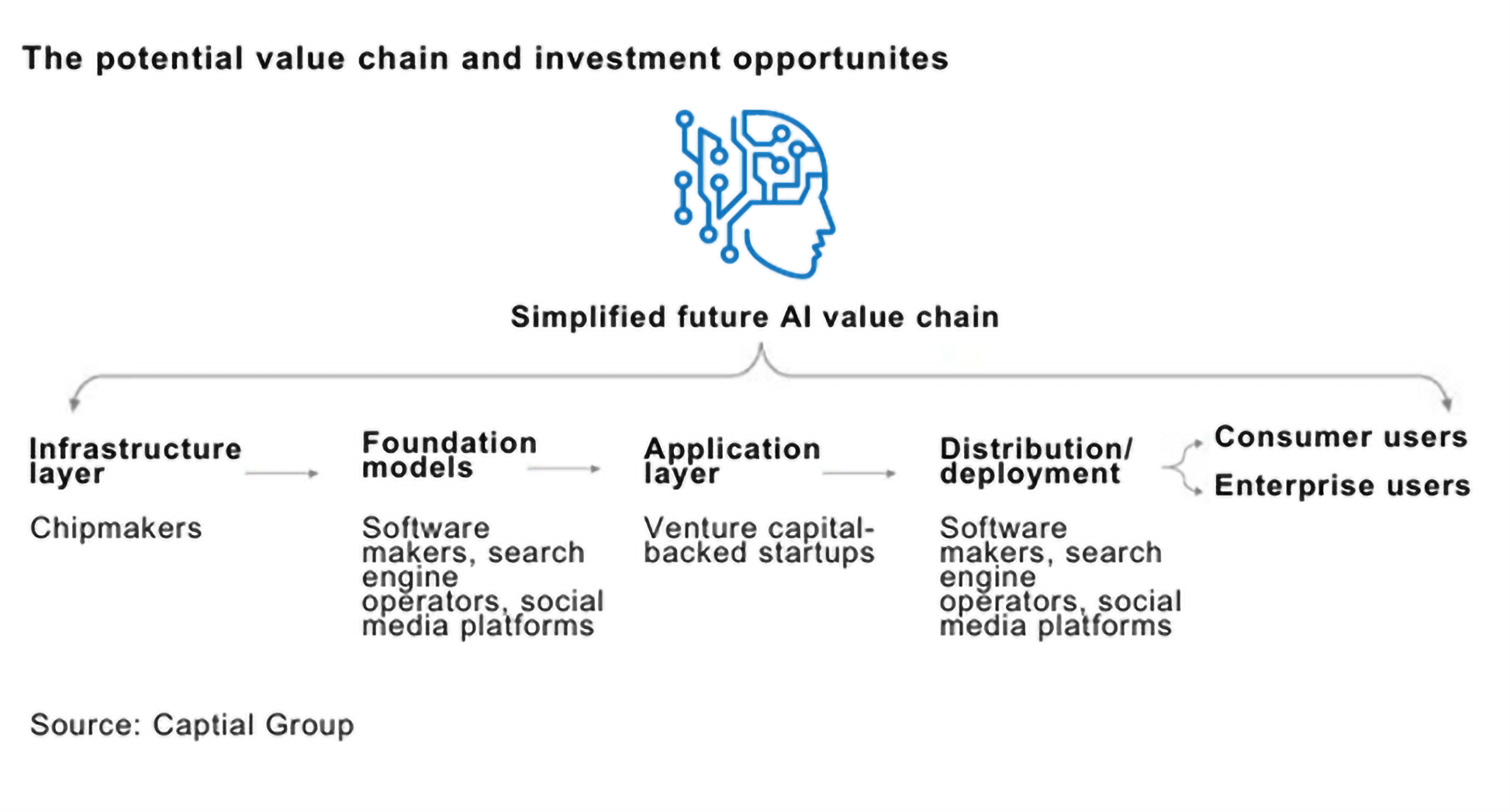

From an investment standpoint, there are several companies and subsectors that are positioned to potentially become winners of this technology. While the technology sector has been an early beneficiary, along with driving stock market returns in 2023, other winners will emerge over time. As technology companies develop and deliver these tools to businesses and consumers, the next stage will be even more captivating as these tools are implemented to unlock potential value across all industries.

The potential value chain and investment opportunities as shown below can range from the building blocks or chip makers to the end users of new products and services. While the market has been focused mainly on the left side of this graph, end users and companies across numerous non-tech industries stand to benefit from increased productivity and higher profit margins as these new tools are implemented.

Investment Opportunities in AI

The AI revolution has put companies into three important groups, each with its unique role in shaping this technology’s path. These categories of companies together shape how artificial intelligence grows and changes over time.

Companies that offer cutting-edge hardware, such as Nvidia, are providing the building blocks to run AI.

Pure play opportunities with significant direct exposure to AI and high market share in the space are limited, with only two large-capitalization companies generating a significant portion of their revenues from generative AI – Nvidia and Microsoft. ChatGPT runs on Microsoft’s Azure infrastructure and relies on Nvidia’s graphic processing units (GPUs) for model training and responses. AI models require vast amounts of computing power to train and generate new data. GPUs, specialized computer processors capable of processing large amounts of data simultaneously, are essential for this process. Nvidia, Advanced Micro Devices, and Intel are some of the major players in this space. Nvidia, in particular, has made significant investments in AI and is a leader in the GPU market with its stock price and valuation reflecting this top standing.

The proliferation of AI, both from OpenAI (owner of ChatGPT) and from competitors, has driven strong demand for Nvidia’s products. Microsoft also stands to benefit as co-owner of OpenAI and a provider of cloud computing services.

Companies that have access to large amounts of data, along with strong internal capabilities to process that data, such as Google and Microsoft.

Data is the lifeblood of generative AI, and companies that have access to large amounts of high-quality data should have a significant advantage in this field. Companies such as Google, Amazon, and Microsoft have access to vast amounts of data and have the technical expertise to leverage this data to develop and train advanced AI models. These companies have already made significant investments in AI and have track records of successfully commercializing AI technologies.

Given the expensive hardware platforms required by AI models, much of the work to build, tune, and run these models occurs in the cloud. The big cloud providers, such as Microsoft, Google, IBM, and Amazon first started setting up their AI capabilities back in 2014. It was evident that these models needed to be trained over several years and over large sets of data to achieve a level of sophistication that would be good enough to be released commercially. Now these companies have a clear head start with their access to immense amounts of data and processing capabilities.

Those with top talent that have the technical expertise to develop and implement these complex models, such as IBM, OpenAI, and Baidu.

Another important factor for the success of AI development is the availability of talent. Companies that have the technical expertise to develop and implement these complex models are well positioned to benefit from this technology. Companies including IBM, OpenAI, and Chinese owned Baidu have already made significant investments in AI and have a deep pool of technical talent essential to development of these models. A recent industry wide study by McKinsey and Company noted these companies as having the largest bottom line impact from using AI technology and that they tend to attract the highest performing AI talent.

Other Emerging Competitors

China’s tech giants, like Tencent, Baidu, and Alibaba, were quick to join the generative AI trend, recently announcing plans to test and launch their own ChatGPT-like services. Baidu, which dominates China’s search engine market, announced plans to release Ernie Bot, its own version of ChatGPT which caused a surge in share price.

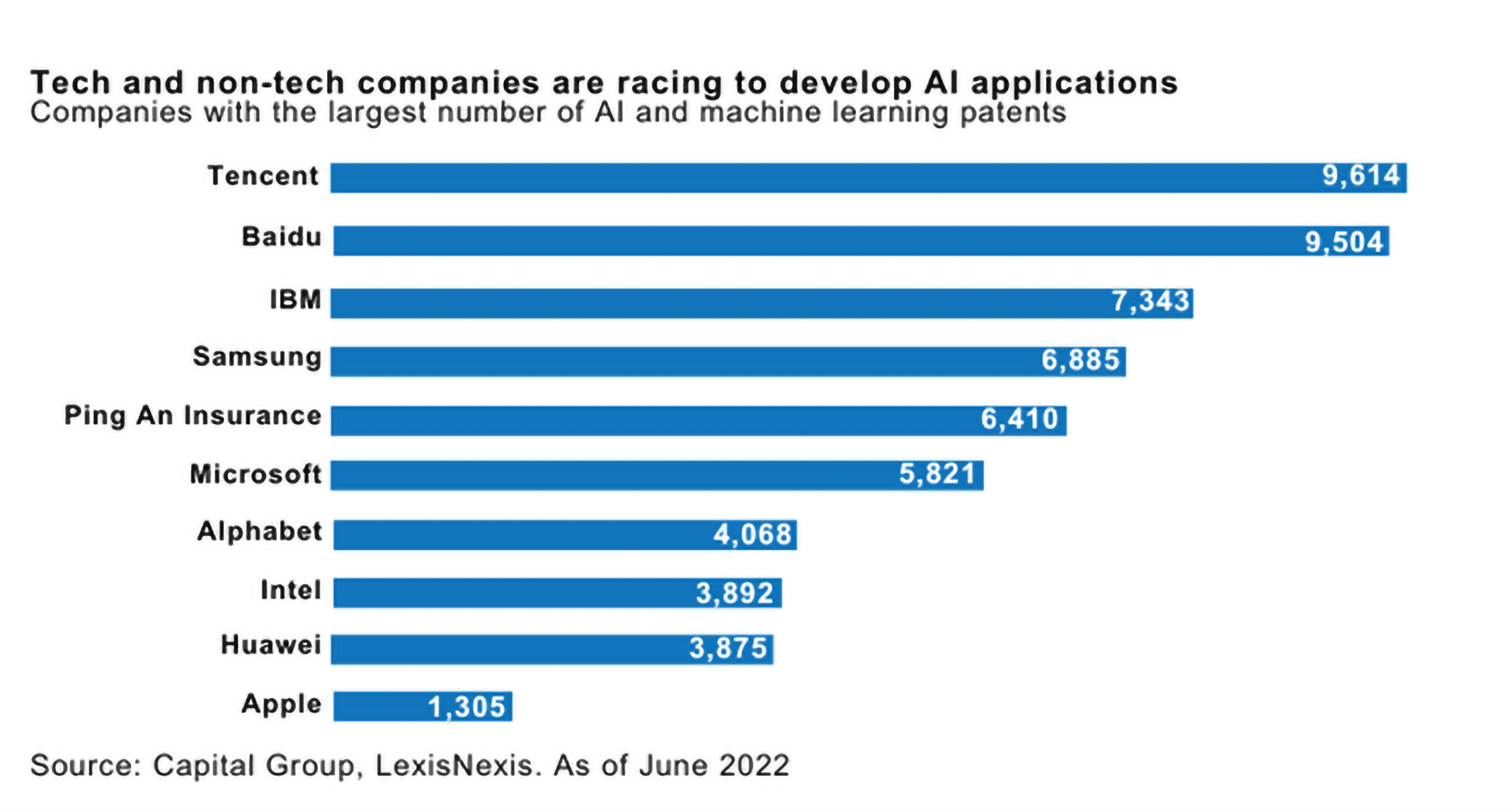

As you can see in the next chart, tech and non-tech companies are in a race to develop AI patents as this technology continues to evolve.

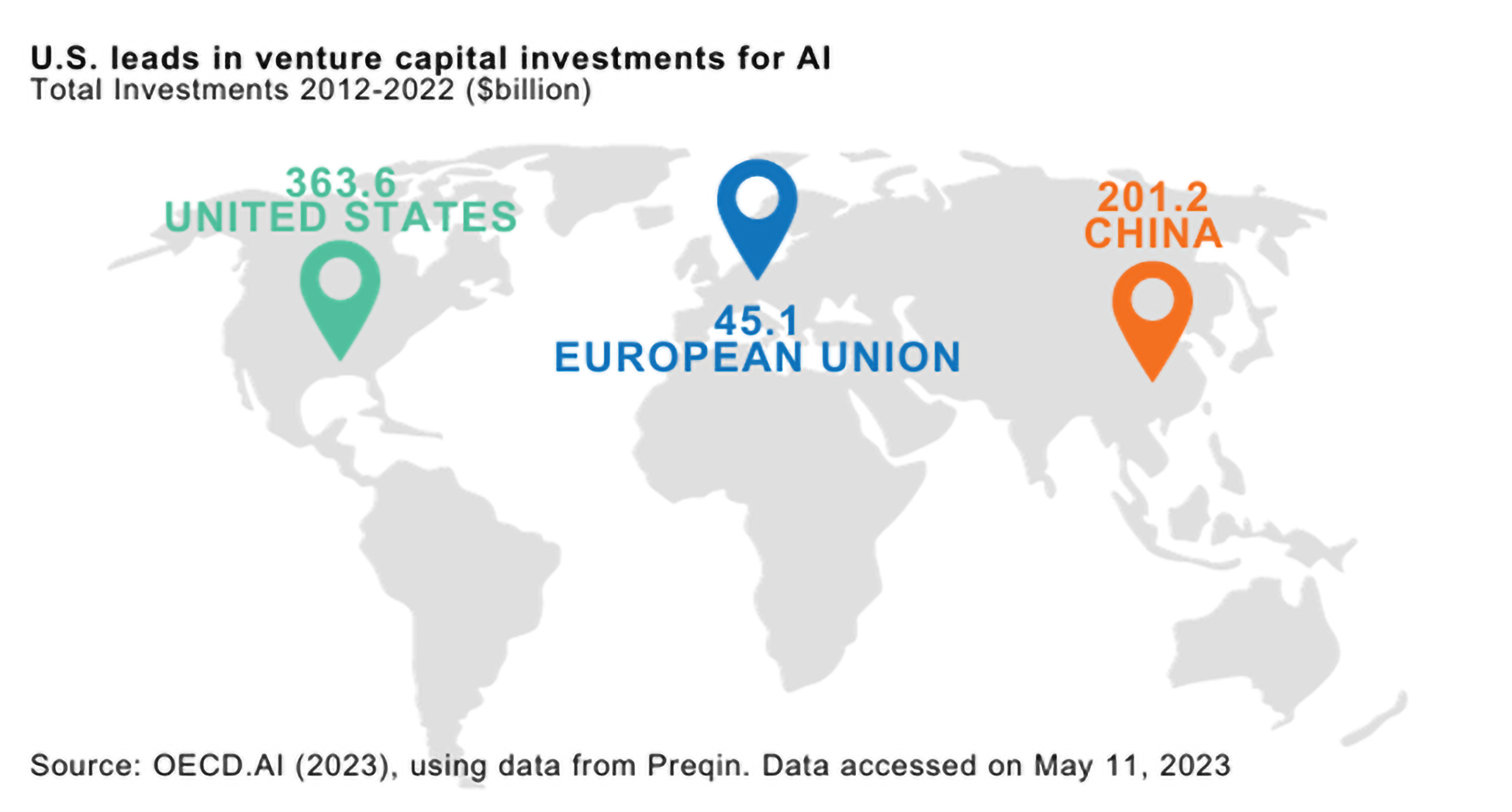

While the China tech giants are two companies at the top of the list for AI patents, the U.S. continues to lead the world in venture capital investment for AI as shown below:

The investment cycle for AI has – and should continue to – produce early winners. But other beneficiaries across the value chain are also likely to emerge over time. Generative AI has come a long way since its early beginning, and it continues to evolve at a rapid pace. While the technology has already been incorporated into many applications, use cases are likely to expand quickly as it matures. From creating new and original content to revolutionizing industries, generative AI has the potential to shape the future in countless ways. We will continue to monitor and evaluate developments in the AI space along with how our client portfolios are positioned to participate in the growth of this revolutionary technology.

Smith + Howard Wealth Management:

As Artificial Intelligence reshapes industries and economies, the potential for smart investments is undeniable.

At Smith + Howard Wealth Management, our team of advisors is available and ready to answer your questions on these or other topics related to Artificial Intelligence. Please call us at 404-874-6244 or email us here.

Please let us know your comments and questions and we look forward to hearing from you.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Back to Insights

Back to Insights