Technology has always played a significant role in shaping the economy, with innovations driving economic growth and changing industries. Each wave of tech innovation has left its mark while also impacting our daily lives. As the world faces the next wave of innovation around artificial intelligence (AI), its potentially transformative impacts are generating immense interest.

In our previous article we explained what AI is and how “smart” it is. In this article, we will explore the possible economic impacts and changes in the labor force resulting from the adoption of AI. While the automation opportunities AI presents have created fears of widespread job displacement or elimination, many studies argue the increase in worker productivity and creation of new jobs will be positive for economic growth.

Change in Labor Force

History has shown that for all the jobs lost to technological advancement – steam engine mechanics, toll booth operators and switchboard operators, to name a few – new jobs have been created. One study found that 60% of today’s workers occupy jobs that didn’t exist in 1940. Since then, 85% of employment growth has consisted of new jobs that technological innovations created.

Boston Consulting Group partnered with Faethm, a firm specializing in AI and analytics, in a study that projects one additional job will surface for every six jobs AI technologies automate or augment. Their study predicts that new roles developing, implementing and running new AI programs will appear in nearly five dozen occupations.

For example, companies have already begun hiring “prompt engineers” to communicate effectively with large-language AI systems such as ChatGPT. Anyone who has tried to use the free online version of ChatGPT from OpenAI can understand the need to properly frame your prompt or request to get the desired output.

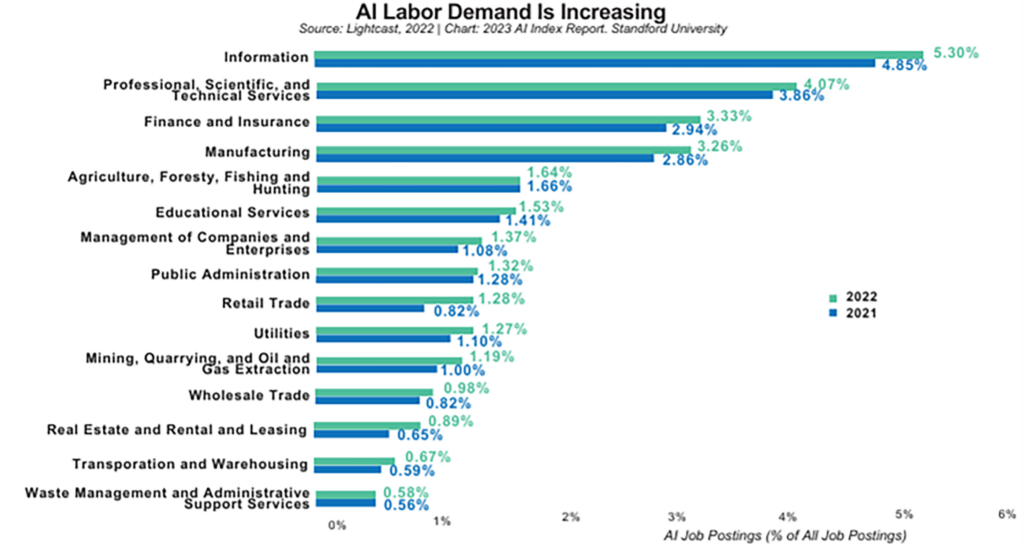

ZipRecruiter reports that hundreds of additional job postings mentioning AI appear monthly. Figure 1 shows demand for AI labor across industries increasing in the past few years and these number will likely continue to go up:

Productivity Gains

In addition to new jobs created by AI, workers in existing roles can undertake higher-value tasks while AI manages more tedious, ordinary duties. These include certain clerical, administrative, computational, and manual duties in various blue-collar and white-collar positions. Office and administrative support positions – secretaries, bill collectors, and office assistants – have already seen their numbers declining as computer software upgrades have automated many tasks over the past few decades. Office support positions already employ 1.3 million fewer workers than in 1990. The U.S. Labor Department forecasts a further decline of 880,000 office support positions by 2031.

Goldman Sachs estimates that AI will boost annual U.S. labor productivity (output per hour worked) by 1.5 percentage points in the first decade after its widespread adoption. That additional increase in the rate of productivity would be an incredible boon to the economy given that the long-term labor productivity rate from all sources has only totaled 2.2% in the U.S.

Currently, 81% of U.S. businesses now employ a form of AI technology, up a third in just five years. A 30-fold increase in AI patent filings between 2015 and 2021 indicates businesses will develop additional ways to use AI in the coming years. Of course, how they use, and harness AI’s productivity potential will vary from industry to industry and company to company. Consultant McKinsey & Co. estimates AI could automate a quarter of all work activities by 2030.

Other professions that will likely be impacted by AI include writers and other written content producers, the legal profession, and healthcare providers. Media jobs across the board – including those in advertising, technical writing, journalism, and any role that involves content creation – may be affected by ChatGPT and similar forms of AI. AI tools can analyze and interpret vast amounts of language-based data to improve efficiency of the tasks required to produce written output.

Paralegals who spend much of their time reading and assimilating large amounts of written case work into concise summary briefs can use AI to significantly reduce the time required for their work. However, AI won’t be able to fully automate these jobs since human judgement is still required to understand what a client or employer wants. The task of researching data and writing summaries may become more efficient with these tools, but a professional’s reasoning and strategy advisory role cannot be replaced. Also, given the occurrence of inaccurate data generated by large language models, as noted in our previous article, human review of AI output remains a requirement.

The healthcare profession is one that obviously requires a high level of human judgement and is subject to human error. AI-powered software can analyze X-rays, MRI’s or CT scans to help

radiologists improve the accuracy rate of their diagnoses and reduce the number of errors. AI could eventually help paralyzed individuals perform day-to-day tasks. AI powered robotics might be able to close the large gap in healthcare workers needed in the coming years to care for the aging population.

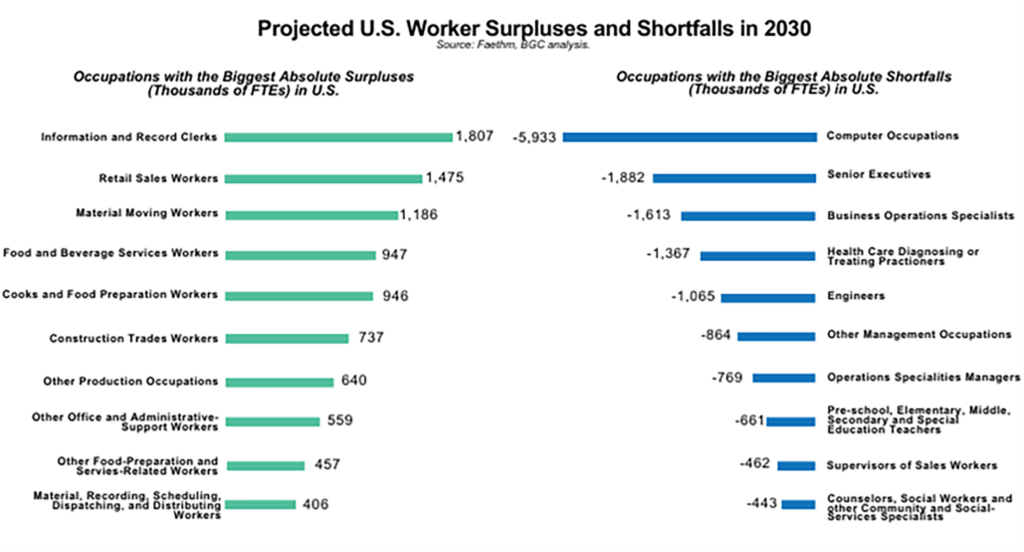

Figure 2 shows the forecasted occupations with the highest number of job surpluses (too many workers and not enough jobs available to them) and shortfalls (not enough qualified workers to fill the number of available jobs) due to AI adoption from the BCG/Faethm study. Researchers believe AI will create a surplus of information and record clerks. The retail industry is another sector that will likely see a high amount of job displacement with one study estimating one third of retail jobs displaced by 2030. At the same time, they project a shortfall of qualified workers to fill computer occupations. Filling the projected computer roles and senior executive positions could determine the path of AI adoption and the allocation of capital investments required to realize the full potential of AI technology.

Although new technologies will eliminate some occupations, there are many areas they will improve the quality of work that people do by allowing us to focus on more strategic, value-creating, and personally rewarding tasks. Many occupations will see an improvement in efficiency and productivity as AI tools are adopted over time. There is still a lot of human judgment that goes into each of these professions that cannot be replaced by technology, including when and how to implement AI.

Economic Growth

The productivity improvement AI drives should directly boost economic growth. There is a wide range of estimates, so the question is by how much and over what time period. During the next decade, Goldman expects AI to increase global gross domestic product (GDP) by 7%, equaling about $7 trillion. Recent research from McKinsey estimates that AI could add the equivalent of $2.6 trillion to $4.4 trillion annually across 16 global business functions.

Investment in the global AI market – software, hardware, and services – is expected to reach $900 billion by 2026 and $2 trillion by 2030. AI could expand the economy profoundly in the U.S., doubling annual GDP potential to 3%, given the U.S. is a leader in creating new technology. Yet, getting there could take a while.

The perspective the world receives from the media, including the stock market reaction to AI, likely bears little relation to what really happens in the world’s research labs. Artificial Intelligence, like steam engines or electricity, is a general-purpose technology that will take time to be adopted across industries. Currently, there are only a few, highly experienced companies developing and deploying AI models or products profitably in their product lines. Most companies are just getting started with AI and eventual, future AI winners might not even be founded yet. We will discuss this topic in our next article covering investment opportunities related to AI.

The explosion of interest in AI this year has fueled a major rally in technology stocks, with a concentrated group of large US companies leading the market higher. This slate of “early winners”, including makers of semiconductors needed to build AI technology and cloud service providers with the computing infrastructure to commercialize it, returned roughly 60% through the first eight months of 2023, according to Goldman Sachs Research. Examining the characteristics of prior waves of technological innovation – and the investment bubbles that often came with change – can be helpful to understand current investment in AI-related stocks and future opportunities.

Two of the “early winners” that are easy to identify include Nvidia (dominant provider of specialized graphics chips used to power AI applications) and Microsoft (OpenAI’s cloud partner), with both stocks up significantly year-to-date, but now also trading at hefty valuations. The opportunity won’t be exclusively within tech companies though, many other companies and sectors will benefit from AI’s productivity gains as this new technology is implemented. We will explore how these companies are building out the AI infrastructure along with other sectors who stand to benefit from AI in our next article.

Please let us know your comments and questions and we look forward to hearing from you.

Smith + Howard Wealth Management:

As Artificial Intelligence reshapes industries and economies, the potential for smart investments is undeniable.

At Smith + Howard Wealth Management, our team of advisors is available and ready to answer your questions on these or other topics related to Artificial Intelligence. Please call us at 404-874-6244 or email us here.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Back to Insights

Back to Insights