People often think investors (even when those investors are themselves) bend toward rationality when making decisions. Traditional financial theories are built on the assumption that investors make rational decisions based on all available information. However, reality tells a different story.

We can unpack this story thanks to a relatively new area of study called behavioral finance. Behavioral finance sheds light on the psychological factors that influence investment choices. In this article, we will explore the field of behavioral finance and provide examples to illustrate its key concepts. It is important to note that when I mention “investors,” I am broadly speaking about the market as a whole and those who make up the market, investors.

What is Behavioral Finance?

Behavioral finance is an area of study that combines insights from psychology with traditional economics to explain why investors sometimes make irrational rather than rational financial decisions. It recognizes that investors, who are otherwise rational individuals, do not always make rational decisions, especially in the context of investments. Such decisions are often influenced by cognitive biases, emotions, and social factors. Behavioral finance aims to understand these tendencies and their impact on markets and personal investment portfolios.

Why Should This Matter to You?

An understanding of behavioral finance is helpful for individual investors as well as investment advisors, like the team at S+HWM. For the individual investor, gaining insight into why they may feel compelled to make what seems like a rational choice on an investment decision could help them consider a wider perspective and make a wiser decision. Behavior can be modified and is most successfully modified when there is knowledge to back it up.

For investment advisors like us, an understanding of behavioral finance helps us better understand our clients, provide thoughtful perspective that addresses their concerns, and coach them through difficult market environments.

Below are four key concepts that shed light on how investors’ decisions can be influenced in subtle, often unseen ways.

Key Concepts in Behavioral Finance

- Loss Aversion: Loss aversion is a cognitive bias where individuals tend to feel the pain of market losses far more than they feel the pleasure of equivalent gains. Research has shown the impact of loss to gain can be double. As such, investors often make conservative decisions to avoid potential losses, even at the expense of higher gains. Think about it: what’s the gut reaction many people have when the market sells off? They too want to sell! However, if the market has sold off in a large way, investors can benefit from stepping back and weighing the benefit of buying rather than selling. Market valuations are most likely discounted in these situations and may make for a good, discounted purchase. Unfortunately, all too often, investors are motivated by fear and loss rather than logic and the opportunity for gain. The potential future gain of purchasing an asset at a discount is negated by the fear of losing more, which leads to an irrational decision to sell assets low rather than high and miss an opportunity to buy low.

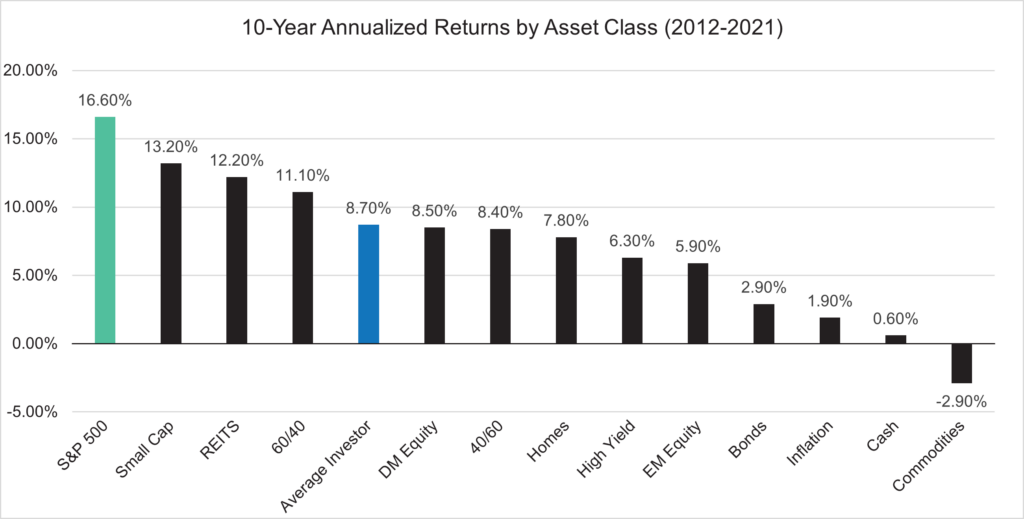

- Overconfidence Bias: Overconfidence bias occurs when individuals overestimate their investment knowledge and expertise. This can often lead to excessive trading, high-risk investments, and ultimately, poor portfolio performance. An overconfident investor may trade frequently, incurring higher transaction costs and taxes (short-term capital gains vs. long-term capital gains). They may also try to “time” the market, and thus either enter or exit an investment at inopportune times. In fact, a look at asset classes between 2012 – 2021 shows that the average investor had an annualized return of 8.7%, compared to the S&P 500’s 16.6% annualized return. That is underperformance of almost 50%! The key takeaway: sometimes we are our own worst enemy.

Source: Bloomberg,FactSet,Standard&Poor’s,J.P.MorganAssetManagement;(Bottom)Morningstar,MSCI,NAREIT,Russell.

Guide to the Markets–U.S.

- Herd Mentality: Herd mentality refers to the tendency of individuals to follow the proverbial “crowd” or “herd” and make investment decisions based on what others are doing rather than conducting thoughtful research and observing underlying fundamentals of their investments. Herd mentality may be the most common and well-known bias, as there is no shortage of examples. One very public example from late 2020 involves a seemingly troubled company named GameStop which reported dismal earnings due to a multitude of factors. With the help of social media and a very interconnected world, many retail investors collaborated and bought the company’s stock despite their troubling fundamentals. This caused the stock price to skyrocket and brought in more retail investors. Wash, rinse, repeat and ultimately a bubble developed. However, when the dust settled (or the water drained, in this case), the bubble burst, and the stock price continues downward from an inflated all-time high of almost $90, sitting at just over $12/share as of this writing. See chart above for an illustration of the dramatic swings the stock price underwent.

- Recency Bias: Recency bias is the tendency of individuals to follow the adage “what works today will work tomorrow” even when making investment decisions. This is a risky and ill-advised approach. In fact, we believe it is quite the opposite. What worked today, or in the past, may well not work at all tomorrow. This is something that is currently hitting a little too close to home. I am a die-hard Cincinnati Bengals fan. My whole life they were – from a winning standpoint – mediocre at best. However, within the last three years, the Bengals won an AFC championship (playing in two) and appeared in a Super Bowl. Based on their recent play and offseason acquisitions, I expected nothing short of a playoff appearance for the 2023 season. As of this writing, the Bengals are 5-6, have no divisional wins, their star quarterback is out for the season, and their chances of making the playoffs are infinitesimal. In fact, there are many nuances, most of them unpredictable, that cause fluctuations in football success making it unreasonable to expect the same results year in and year out. Similarly, markets fluctuate over time and even within bull markets, will have periods of downward trends. What works today may (or may not) work tomorrow. It is important for investors to have a deep understanding of the cyclical nature of the markets and the ability to resist the temptation of giving undue weight to recent events and market trends when making investment decisions. As financial advisors, we add perspective on recent events and market cycles in our investment advice.

Conclusion

As an investor, an understanding of behavioral finance brings insights into the nuances and sometimes emotionally-charged aspects of investing. In a world where emotions often run high, a deeper understanding of behavioral finance is a valuable tool for navigating the unpredictable short-term waters of financial markets.

As advisors, behavioral finance helps us understand and predict how individuals may react and internalize market concerns thus better serving them, bolstering our advice with reliable data, and giving them confidence in their decisions.

If you’d like to discuss this topic or would like to know more about our approach to financial planning and investment management, please contact me here.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Back to Insights

Back to Insights