Trade Concerns Continue to Create Angst: 3rd Quarter Recap

by: Smith and Howard Wealth Management

Weakness mid-quarter resulted in stocks finishing the quarter flat while bonds again moved higher. The Federal Reserve lowered rates twice during the quarter, but it was the ongoing U.S. / China trade conflict that appeared to drive trading activity and returns. In commodities, a September 14 attack on two of Saudi Arabia’s largest oil fields resulted in a one-day spike in the price of oil and speculation of a retaliatory strike against the purported attacker (Iran).

An In-Depth Look at the Market Through September 30, 2019

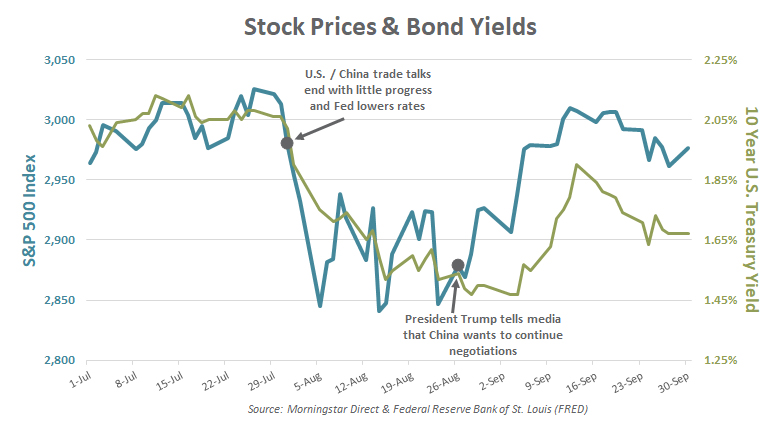

While the Federal Reserve lowered rates twice during the quarter, it was the ongoing trade rift between the U.S. and China that drove trading and returns. After a strong July helped U.S. equity markets climb to record highs, the equity market reversed course sharply in early August as trade talks concluded without progress and each side threatened additional tariff actions. Stock prices and bond yields were highly correlated over the last couple of months (See graph). When stocks fell in early August, investors moved away from stocks and into the perceived safety of bonds. Both moves then started to reverse in late August/early September as the U.S. and China appeared to take a more conciliatory tone and agreed to resume talks.

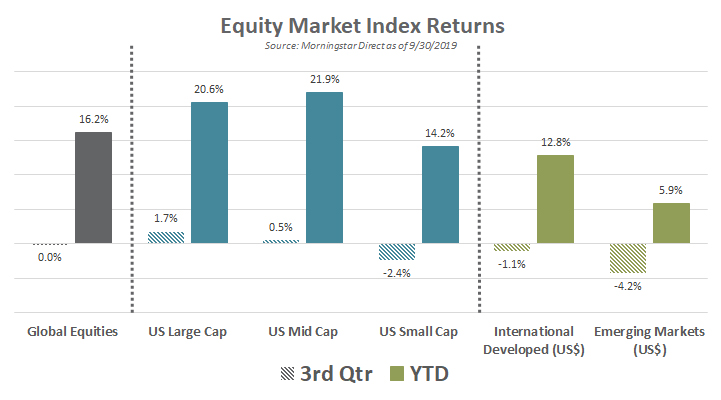

Despite the inability of trade negotiators to strike a deal, global markets have broadly moved higher through the first three quarters of 2019. The strength in returns may vary in magnitude, with the U.S. leading the way, but they have also been solidly positive across the globe.

Equities

Global equities followed a familiar path during the quarter. Much like the 2nd quarter, equities opened and closed the quarter with strong months, but had to weather a trade policy-induced middle month selloff. The result was a global market that finished the quarter where it began, resulting in an overall return of -0.03%. Not surprisingly, a quarter with a flat return means that some segments experienced a loss. U.S. small cap, international developed, and emerging market stocks fell slightly, while U.S. large cap stocks were the only segment to advance noticeably.

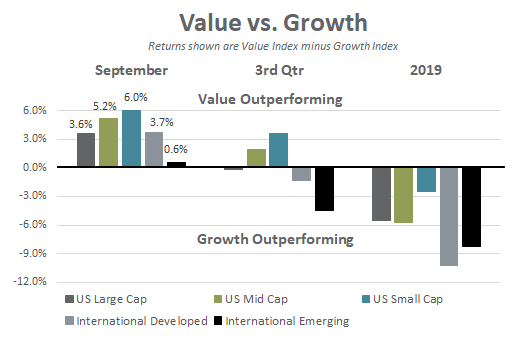

Growth stocks, regardless of geography or market cap, have consistently and meaningfully outperformed value stocks over the course of 2019, as well as much of the last decade. The results between the two were a bit more mixed over the last quarter, however, due to a very strong September for value stocks both in absolute returns and relative to growth stocks. This can be seen in our Value vs. Growth chart where we show the difference in return between value and growth stocks for different markets. Returns above the 0% line indicate value outperformed, whereas returns below 0% indicate growth outperformed. September was a decidedly strong month for value stocks. It would be premature to say that any type of permanent rotation or shift has begun, but the difference in returns was the largest in favor of value since 2009 and had many speculating that a larger shift was to still to come.

Bonds: Bond Investors Enjoy Boost to the Bottom Line – But for how long?

It may be hard to believe, but roughly one year ago the 10-Year U.S. Treasury bond hit an intra-day high yield of 3.26%. Investors, expecting additional rate increases from the Federal Reserve, believed that rates could climb even higher with many prognosticators claiming that a yield of 4% for the 10-Year was within reach. That intra-day 3.26%, however, turned out to be the end of a steady increase in yields for the 10-Year that had begun in July of 2016. Now, just one year later, the 10-Year yield has fallen to just 1.67%, a level last seen (yes, you guessed it) in July of 2016. So the yield on the benchmark bond has gone full circle in a period of just over three years. This shift to lower yields is also happening outside the U.S. to an even greater extreme. A number of developed markets are now experiencing negative yields on government bonds. Most notably the end of quarter yield for the German 10-Year Bund was -0.56% and the Japanese 10-Year JGB -0.22%.

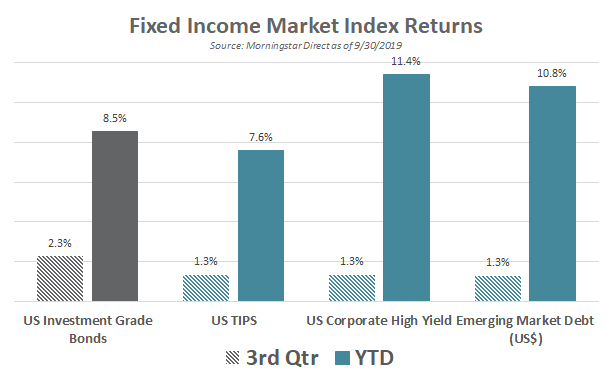

Interest rates and bond yields are inversely correlated with bond prices, so the continued drop in yields has provided a nice boost to the bottom line for bond investors (see accompanying graph). Unfortunately, experienced bond investors also know that returns driven by falling yields are really just fast-forwarding or borrowing returns from the future. Lower current or starting point yields mean lower return expectations moving forward.

More opportunistic or credit-sensitive areas of the bond market also did well during the quarter, but they did not benefit to the same extent from the drop in government bond yields. Slightly wider credit spreads offset a portion of the gains derived from the falling government benchmark yields, so despite higher yields to maturity credit-sensitive bonds underperformed U.S. Treasuries and bonds of other highly rated corporate issuers.

Real Assets – Commodities and REITs: The impact of the attack on Saudi Arabia’s oil fields

Several areas within our Real Assets category saw large quarterly moves, but the most significant event for global investors happened within oil. On Saturday, September 14th two of Saudi Arabia’s largest oil fields were attacked, causing a major disruption to global oil supplies. These two fields alone account for roughly half of Saudi Arabia’s daily output and close to 5% of global oil supply. The attack caused the largest intra-day percentage move ever in the price of oil with Brent crude futures soaring 19.5% before closing the day up 14.6%. The move proved fleeting, however, as oil eventually finished the quarter -7.1% lower. Gold and REITs experienced increases during the quarter, but none appears to be directly linked to the attacks in Saudi Arabia. The Saudi’s and several major intelligence agencies have placed the blame for the attack on Iran, but no military action has been announced or undertaken to date.

Contact Brad Swinsburg 404-874-6244 with questions or to learn more about how Smith and Howard Wealth Management serves affluent individuals and their families.

Explore more information on the third quarter of 2019 by visiting these links:

Market Outlook: Third Quarter 2019

On the Horizon: Third Quarter 2019

A Deeper Dive: Third Quarter 2019

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.