Summary: Fourth Quarter 2018

by: Smith and Howard Wealth Management

Most investors understand or at least acknowledge that markets don’t go up consistently or constantly. Periods of excessive volatility and negative returns eventually occur and can happen at almost any time for any number of reasons. That understanding, however, certainly doesn’t make these difficult periods or markets any less scary or painful. This past quarter is yet another stark reminder of just how scary they can be.

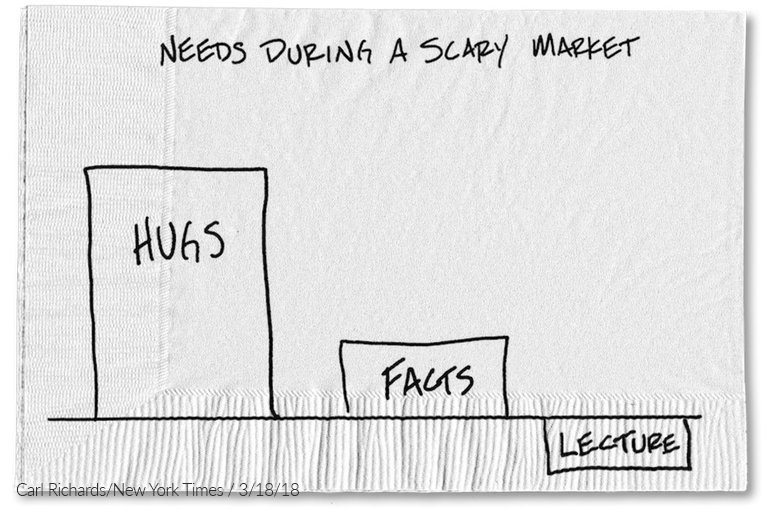

During such trying periods, market movements are often violent and seemingly irrational. Investor emotions cycle through various degrees of fear and supplant fundamentals as the primary driver of market prices for periods of time. Recognizing the importance of investor psychology in navigating tough markets brought to mind an illustration by New York Times columnist and Certified Financial PlannerTM, Carl Richards (also known as the Sketch Guy).

As we’ve detailed throughout this CFO Report, we believe investment fundamentals (and facts) will ultimately drive markets and returns. Investors who maintain their discipline, focus on the long-term, and ideally take advantage of volatility will eventually be rewarded. That knowledge and expectation is helpful, of course, but as Mr. Richards implies, sometimes it isn’t what investors want or need most during trying times. While you may not necessarily be looking for a “hug” from your financial advisor, please know that we stand ready to answer any questions you may have or help in any way we can. Experience tells us that difficult markets are part of investing and such periods will eventually pass, but that doesn’t make any of us immune to the emotions that accompany them.

Contact Brad Swinsburg 404-874-6244 if you would like to discuss our views on the economic outlook for 2019.

Explore more information on the fourth quarter of 2018 by visiting these links:

Market Recap: Fourth Quarter 2018

Market Outlook: Fourth Quarter 2018

On the Horizon: Fourth Quarter 2018

A Deeper Dive: Fourth Quarter 2018

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.