Stay the Course: There’s a Cost to Timing the Market

by: Smith and Howard Wealth Management

In a volatile environment like the one we find ourselves in today, some investors want to take action just to take action. It can definitely make people feel better. But oftentimes in investing, that’s exactly the wrong thing to do. The evidence is overwhelming that most investors diminish their long-term returns trying to do so. They are more likely to chase the market up and down, and get whipsawed, buying high and selling low. Market timing, while tempting, involves getting two nearly impossible decisions right: when to sell and when to get back in.

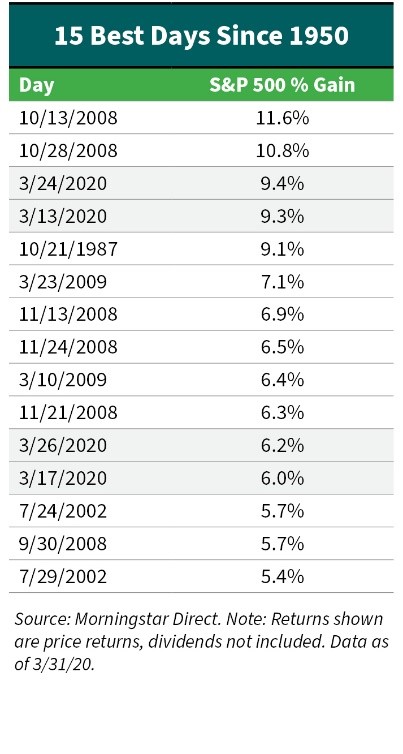

Missing the Best Days

The table to the right shows that the 15 best days for the S&P 500 all occurred within bear markets, not bull markets as you might expect. That is, the times when it’s hardest to remain invested or tempting to get out of the market and wait for better days. Looking at these dates, you’ll find the who’s who of dark times for the stock market: the 2008 financial crisis, the dot-com crash, the Black Monday crash of 1987. A handful of these best days happened in the first quarter of 2020, which by any definition was historically bad.

By trying to miss the worst days, investors are very likely to miss the best days. “Recency bias” suggests that someone’s most recent experience has the greatest influence on their decisions. As such, investors tend to sell after a meaningful market selloff and buy after a market rally.

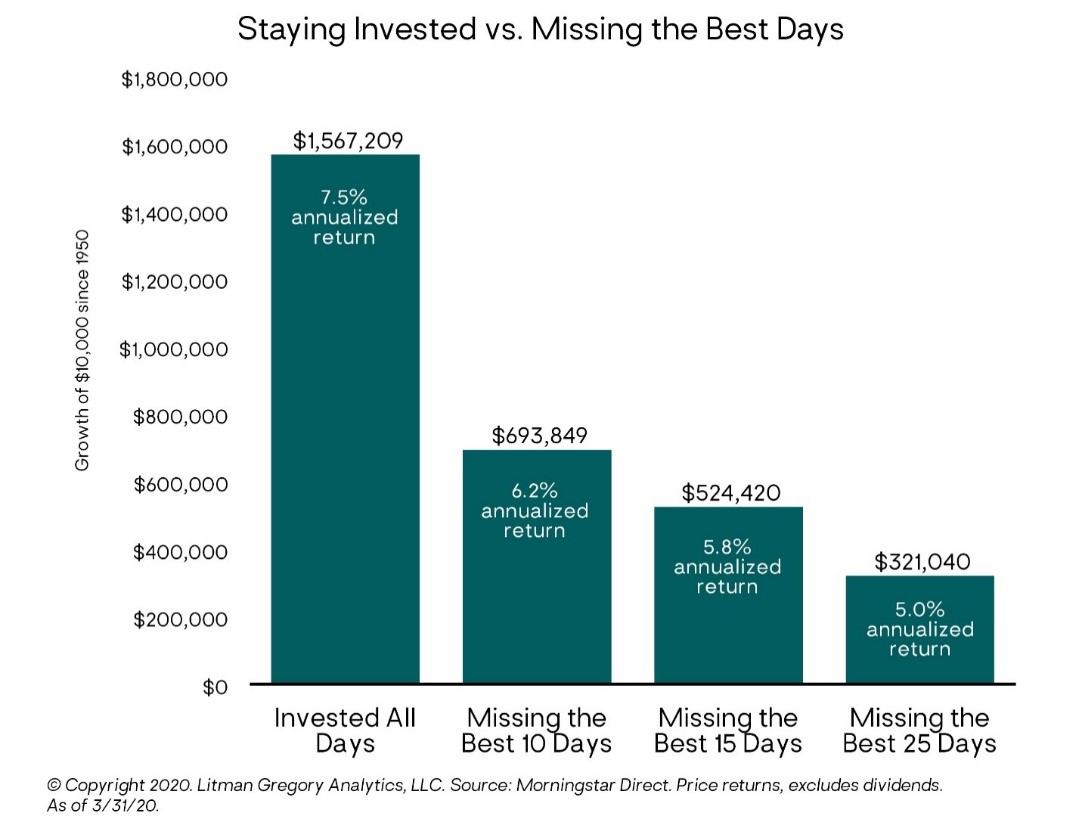

Missing just the 10 best days (out of more than 17,500 trading days since 1950) has a huge long-term effect on a portfolio. For example, an investor who invested $10,000 in the S&P 500 in 1950 would have gained 7.5% annualized and finished with a portfolio value of more than $1.5 million (as of 3/31/2020) if they had remained fully invested (not including dividends). The final portfolio value for an investor that missed the 10 best days is much, much lower—just shy of $700,000.

Now it is unlikely an investor will only miss the best days if they attempt to time the market. They might also be able to miss some of the historically bad days. However, the cautionary tale of attempting to time the market is the same: There can be a huge cost to pay if the market swings to the upside while you’re on the sidelines. It would take exceptional timing skills to get in and out of the market perfectly, particularly since it needs to be done in short order given the market’s best and worst days tend to cluster close to one another. Staying the course is the best plan of action during periods of severe market stress. There is an old investing adage: “Time in the market beats timing the market.”

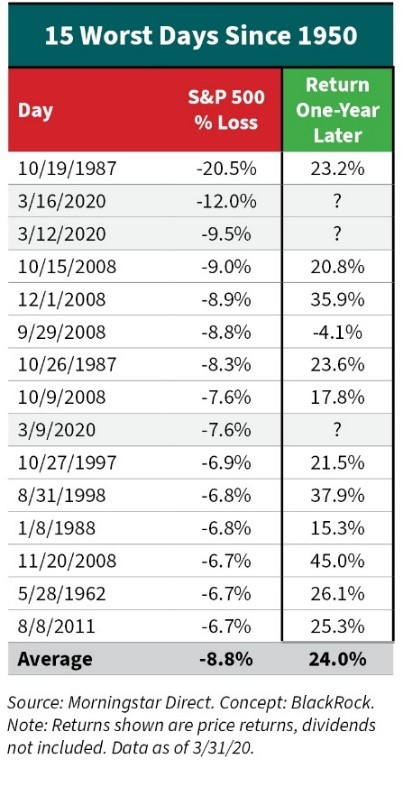

Owning stocks on historically bad days can be unsettling, but outcomes over the next year tend to be favorable. BlackRock recently published a table showing one-year returns following the worst days for the S&P 500. The average one-year return after a historically bad day has been 24%. And there has only been one instance of a negative return.

Staying Invested, Staying Disciplined, Taking Advantage

Part of our job as your wealth advisor is to help you stay true to your investment strategy guidelines and discipline, both for your existing investments and for the cash you plan to invest over time. We don’t want to sell out of the equities you already own during this downturn, only to try to decide when to jump back in so we catch the rebound. On the contrary, we want to stay invested, the only sure-fire way to capture a recovery in prices. What’s more, we will want to prudently and incrementally add more to stock allocations as forward-looking returns look more and more attractive. With this strategy we hope to catch some of the best prices in this market cycle. The potential higher returns should bolster your financial situation in the years to come.

If you have questions or wish to discuss, please contact your Smith and Howard Wealth Management advisor or Rob Kaercher at 404-879-3116 or by email here.

Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by Smith and Howard Wealth Management with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.