Russia’s invasion of Ukraine has triggered a swift response from U.S. and European governments. The range of financial, economic, and technological sanctions is being widely reported, but the impacts are not expected to deter Russian aggression.

Sanctions take time to implement and to be felt, and the current list of sanctions appears to be incremental. The U.S. has severed Russia’s largest financial institution (Sberbank) from the U.S. financial system while other large Russian banks have access with certain sanctions applied. Imposing restrictions on access to SWIFT (Society for Worldwide Interbank Financial Telecommunication), the global payment system, is a possibility. This could be a huge blow to the Russian economy, but a plan has to be coordinated with European leaders who control access. Restricting SWIFT access could also negatively impact Western business interests such as major oil companies and create a wide range of other disruptions with trade partners. For example, Europe has deep trade ties with Russia and relies heavily on Russia’s natural gas exports so the impact of any additional moves must be carefully evaluated.

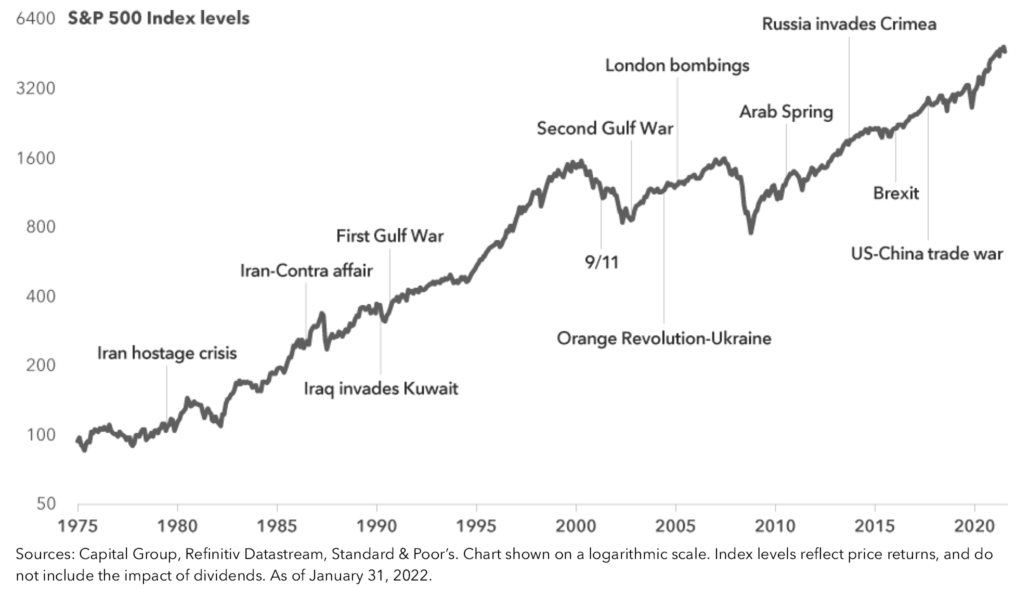

While equity markets have historically powered through geopolitical events, it appears that initially, major disruptions will be felt in the energy sector primarily in Europe. The situation is very fluid with a wide range of possible outcomes. We believe the current financial risks include higher oil and gas prices and the potential impact elevated commodity prices could have on central bank policy.

Though equity markets have recovered from large intraday declines this week, the price of oil reached $100 a barrel for the first time since 2014. Oil prices retreated back to the low $90s today, which is still an increase of almost 60% over a year ago. Previous instances of geopolitical uncertainty, such as when Russia invaded Crimea in 2014, have shown that higher oil prices can have a significant drag on global economic activity.

From a European perspective, the more serious concern is an increase in already elevated natural gas prices. Higher gas prices may indicate a significant disruption of Russian gas supplies to the European Union. This will be especially problematic for countries such as Germany and Italy, two of Europe’s largest economies.

Germany’s announcement that it would not certify Nord Stream 2, a new gas pipeline from Russia to Germany, does not have any direct impact on supply as it’s not yet operational. Still, it’s possible we could see more significant disruption to Europe’s supply if Russia retaliates by restricting exports to the European Union. This would hurt the Russian economy as well, of course, but Russia has built up its currency reserves to protect against this event.

Oil prices tend to quickly impact prices consumers pay at the gas pump. But the pass-through on gas prices from wholesale to retail varies, especially given support from the governments seeking to protect consumers. Recent increases likely will continue to feed into consumer prices over the next few months.

The other pressing issue for financial markets is the widely expected increase in interest rates this year. The U.S. equity market had already been weighed down in 2022 in anticipation of higher rates and concerns on inflation. It would not be surprising if the Federal Reserve and the European Central Bank now proceed more cautiously in terms of tightening monetary policy. Both will wait to see how financial markets and commodity markets react to the Ukraine crisis. Ultimately, the Fed will likely raise interest rates but may do so more gradually than markets anticipated a week ago. A slower pace in raising interest rates could also impact the Fed’s goal to curb inflation this year.

This situation of course extends far beyond financial markets, touching many lives in the affected areas. As we watch these global events unfold, we continue to monitor the developing situation. There are many moving parts to this crisis and a bigger implication might be to move away from the globalization that has occurred over the past few decades. We welcome any questions or comments you may have. Please contact any member of our team to discuss any topic in more detail.

We value your continued support and your trusted relationship with Smith and Howard Wealth Management.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Back to Insights

Back to Insights