It’s no surprise the last several years have been a bumpy ride for investors. In the first quarter of 2020, the Dow Jones Industrial Average (DJIA) entered a bear market – the first bear market since 2007. 2022 was no exception as U.S. treasuries had their worst performing year since the inception of our country and the S&P 500 had its fourth worst year since the inception of the index in 1976. Despite the challenges that come with market downturns, there are strategies advisors can leverage to protect investors who are at or nearing retirement.

A market downturn can present investors with tax planning opportunities (i.e., tax-loss harvesting) and can be a favorable time to execute Roth IRA (individual retirement account) conversions.

What is a Roth IRA Conversion?

In the simplest of terms, a Roth IRA conversion involves transferring all or part of the funds from an existing traditional IRA and moving it into a Roth IRA.

The Rules of Roth IRA Conversions

Roth IRAs are popular retirement vehicles because of their tax-free withdrawal benefits, assuming certain conditions are met. Money invested into a Roth IRA is made with after-tax contributions. The maximum contribution limit for Roth IRAs is $6,500 for 2023 ($7,500 if you are age 50 or older). Roth IRAs also have income limits that may only allow investors to contribute a portion of the $6,500 limit or in some instances, make individuals ineligible for contributions. Income limits are based on an investor’s Modified Adjusted Gross Income (MAGI). When compared to other retirement vehicles, Roth conversions are not bound by income limits, nor do they have a restriction on how many conversions can be made in one year.

Choosing whether to contribute to a Roth IRA or a Traditional IRA partially depends on tax rate assumptions. It also depends on assumptions regarding financial performance and market volatility (i.e., timing is an important factor). Focusing on tax rates for a moment, consider the following:

- If a taxpayer expects tax rates to be higher in retirement/withdrawal years than their current rates during saving years, a contribution or conversion at today’s lower rates generates a lower tax cost.

- If a taxpayer expects tax rates to be lower in retirement/withdrawal years than their current rates during savings years, a Traditional IRA may be a preferred retirement vehicle as the tax benefit of a deduction today exceeds the tax cost on the withdrawn funds later.

- If a taxpayer expects tax rates to remain fairly constant between contribution and withdrawal years, then there’s no distinct advantage to one form of an IRA over another from a pure tax rate perspective.

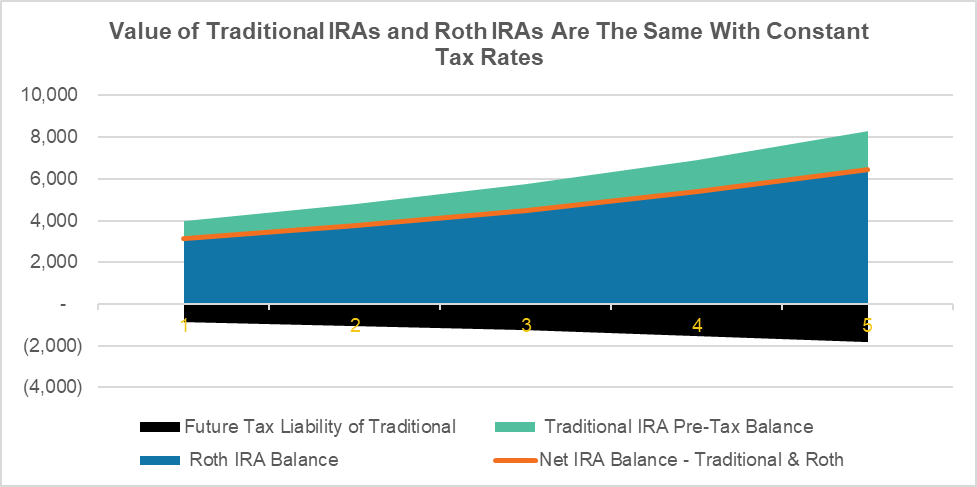

As you can see, tax rates matter. The chart below illustrates the value of Traditional and Roth IRAs. The Y-axis (on the left) shows the value of the account balance. The X-axis (on the bottom) shows the time in years. As you can see, the net of tax value of both accounts is equal when you subtract the future tax liability of the Traditional IRA (black shaded region) from the gross balance of the Traditional IRA (the green shaded region).

We understand there are a lot of moving parts and considerations when it comes to Roth IRA conversions. The examples below address those considerations. As always, if you have questions on whether a Roth IRA conversion is right for you, please contact your financial planner and/or investment advisor.

Example:

Josh has $4,000 and is considering whether to contribute to his Roth or Traditional IRA. He is under the MAGI income limits and is eligible to contribute to a Traditional IRA and receive a tax deduction. One of his other options would be to contribute to a Roth IRA with after-tax dollars. Let’s assume Josh contributes $4,000 to the Traditional IRA and receives a tax deduction for the same amount of his contribution, and the money doubles in value to $8,000 in 5-years. When Josh withdraws funds from his Traditional IRA in retirement, he will owe tax on the gross value withdrawn from the account. Assuming Josh is in the 22% tax bracket at that time, Josh will owe tax in the amount of $880, leaving him with $6,240 in his pocket after he pays his tax.

On the other hand, if Josh contributed $4,000 to his Roth IRA account while also being in the 22% tax bracket – he would need to withhold $880 for taxes. This leaves Josh with $3,120 contributed to his Roth IRA. Assuming he experiences the same 100% cumulative growth as in the example above, Josh would end up with $6,240 to withdraw from the Roth IRA account tax-free. This is the same amount as if he were to fund his Traditional IRA. If your expected future tax rate differs, the outcome will change.

Similarly, when it comes to Roth conversions, they can be timed opportunistically to a tax period where an investor expects their taxable income to be much lower.

Example:

Liz and Josh are 67, working, married, and have Traditional IRAs and a joint-taxable account. Also, their taxable income for 2022 puts their top marginal tax rate at 35%. They plan to retire next year and live off their taxable account savings; this will drop their top marginal tax rate to 24% until they reach age 72 (or 73 in 2023 and 75 in 2033. The 2033 and 2033 age limits were recently adjusted as part of the SECURE 2.0 that was signed into law on December 29, 2022.) when their required minimum distributions raise their top marginal tax rate back to 35%. Assuming Liz and Josh use the standard deduction, they will have four years to open and execute Roth conversions while staying within the 24% marginal tax rate.

Down Markets Put Roth Conversions ‘On Sale’

Reoccurring market declines are an inevitable part of the investment process. For investors that are planning to make Roth conversions, a declining market offers tax planning opportunities while the Traditional IRA is temporarily lower.

With IRA values being temporarily lower in a bear market, it is possible to convert a larger percentage of the Traditional IRA to the Roth IRA, also allowing a higher percentage of the future growth to be shifted into the Roth IRA without moving into a higher tax bracket, as a more sizeable portion of the account is converted.

Example:

Josh and Liz are married with a combined taxable income of $250,000, which puts them in the 24% marginal tax bracket. They both have a $1,000,000 IRA, and they are considering converting $90,000 from Liz’s Traditional IRA to her Roth IRA; this allows them to stay within the 24% marginal income tax bracket. If they converted at the beginning of the year, then this would amount to 9% of Liz’s account being converted to her Roth IRA.

However, assume that Josh and Liz executed the Roth IRA conversion during the middle of the year when Liz’s Traditional IRA is down 21%. The same $90,000 Roth conversion now equates to ≈11.5% of Liz’s traditional IRA being converted to her Roth IRA while remaining in the 24% marginal rate.

As a result, for the same tax cost on the $90,000 Roth conversion, when the market eventually recovers by ≈27% bringing the account back to its original value, instead of having $910,000 in Liz’s Traditional IRA ($1,000,000 – $90,000 = $910,000) and $90,000 in her Roth IRA, Liz will have $889,000 in her traditional IRA ($790,000 original balance – $90,000 Roth conversion + $189,000 growth = $889,000) and $114,300 ($90,000 Roth conversion + $24,300 growth = $114,300) in her Roth IRA.

As you can see from the example above, by completing the Roth conversion during a temporary down market, investors are able to convert a larger percentage of their Traditional IRA to a Roth IRA for the same amount of tax dollars while also pushing a larger percentage of the future growth into the Roth account.

What to Consider

With any transaction or strategy that is dependent on a bear market, there is always a risk that the market will continue to decline after the conversion is made. This brings the question of whether ‘now’ is the right time to execute the conversion, or should an investor wait to see if the market continues to fall? Because of this, advisors and investors who are worried about further market declines should consider Roth conversion-cost averaging, where an investor converts a fixed amount to the Roth IRA at regular intervals vs. making a lump-sum conversion; this is a similar approach to dollar-cost averaging. There is also the barbell approach, where investors convert a larger portion to the Roth IRA earlier in the year, smaller amounts during the middle of the year, and then a large conversion at the end of the year once more clarity is gained on the market.

Note: There are no limits on how many Roth IRA conversions an investor can make per year.

Other things to consider are where an investor pays the tax due to the Roth conversion, preferably from an existing cash or a taxable account, rather than withholding money from the IRA. There’s also the investor’s personal tax situation to consider. Investors and advisors want to be careful that they do not convert too much to the Roth IRA, thus pushing them into a tax bracket that is unfavorable. Because of this, it is important to consult with a tax expert or CPA to make sure that a Roth conversion, and the amount converted, are beneficial.

It’s important to plan and not wait to make decisions at year-end. Our team of advisors can help you make informed, opportunistic, and beneficial decisions during any market period. If you would like to learn more about Roth conversions or have any other questions, please reach out to Michael Mueller here or Jeff Brandon here.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Back to Insights

Back to Insights