On the Horizon: Is Disinflation Over?

by: Smith and Howard Wealth Management

Is the prolonged period of disinflation in the U.S. in jeopardy?

In the past, our On the Horizon segment of Your CFO Report has focused on several themes, data points and scheduled events that could reasonably be expected to impact markets in the short to medium term. For reasons that we imagine everyone understands, 2020 has forced/allowed us to take a different approach at times. This is another one of those times. Similar to last quarter, when we focused exclusively on the election process, we are calling another “audible” and want to dedicate this segment to the topic of inflation.

To be sure, financial markets will undoubtedly be influenced by numerous factors over the course of 2021. The virus, fiscal and monetary policy, valuations and the direction of the U.S. dollar are several that quickly come to mind. In fact, if we were to include inflation among those factors and rank order them in terms of their anticipated impact during 2021, inflation would probably rank towards the bottom. The reason for that is simply that inflation is likely to remain low in the near term. A recovery in the global economy and labor markets is bound to take time and the absence of a “blue wave” during the recent U.S. election cycle reduced the likelihood of large fiscal spending programs that might have created inflationary pressures.

If near term inflation risks are low, why then are we concentrating on inflation? As we’ll discuss, inflation regime changes tend to have a few common themes and today’s economic ecosystem appears to check several of the proverbial boxes.

Historical Inflation Regime Changes

The U.S. has experienced a nearly 40-year period of disinflation (falling levels of inflation), so we can appreciate skepticism that inflation is a threat to the economy in either the short or long term. A 40-year “cycle” certainly seems and feels like something permanent, but we would caution investors from being too complacent. Inflation trends can persist and have done so for long periods in the past before abruptly and meaningfully shifting course.

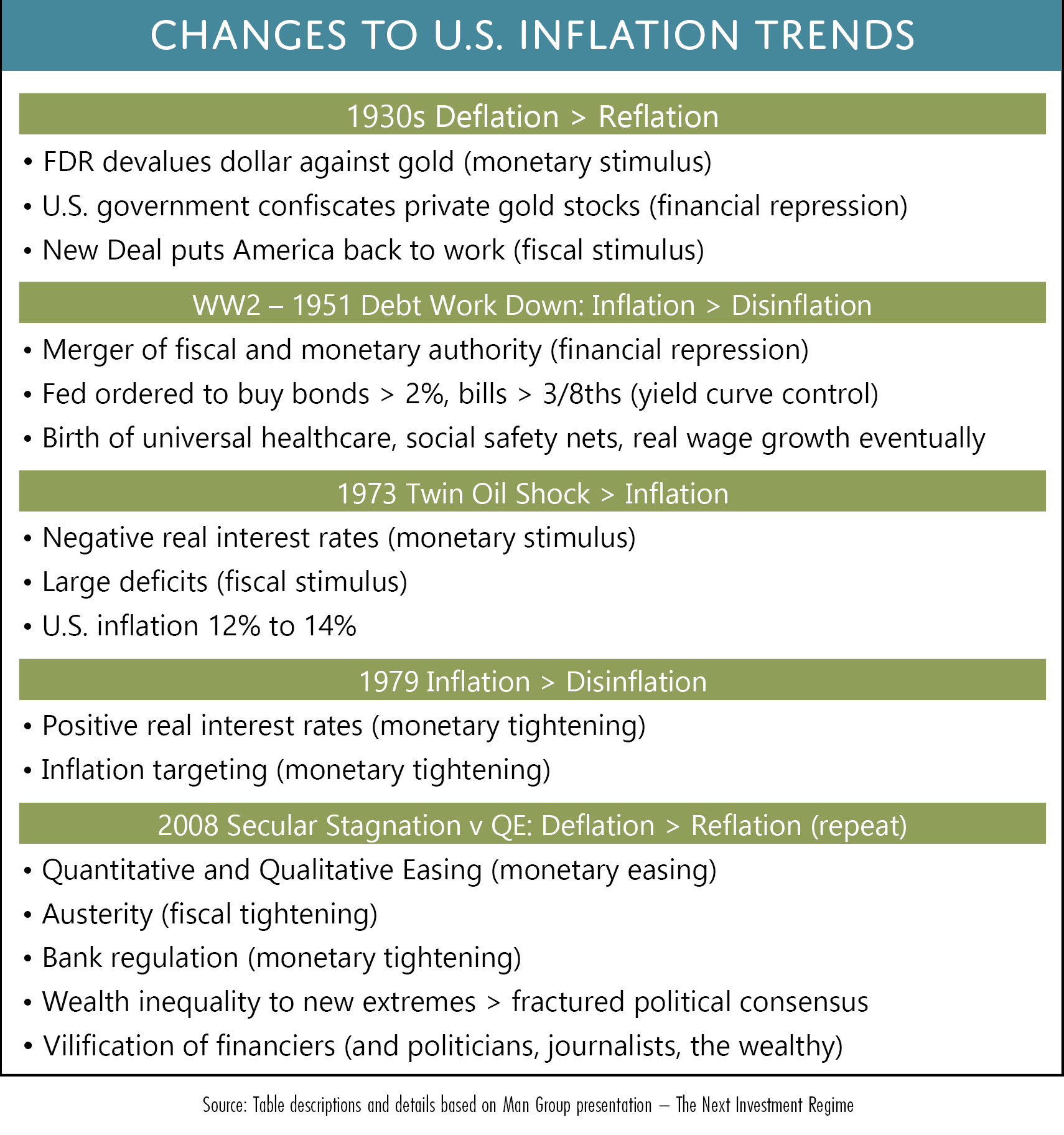

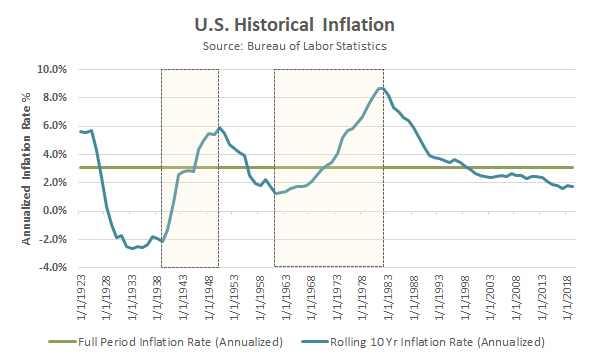

As the accompanying table and chart show, there have been several inflation “regimes” over roughly the last 100 years in the U.S. Two of those periods, shaded in our U.S. Historical Inflation chart, resulted in significant increases in inflation.

Historical references to inflation in the U.S. typically state that inflation has averaged or annualized around 3%. While true (3.1% over the period shown), the graph clearly shows that the rate of inflation has been far from stable. The last 20 years of relative inflation stability have actually been the exception.

A cursory review of the table illustrates that past shifts in inflation trends have occurred around big shocks to the system (Great Depression, WWII, Financial Crisis, etc.) and been heavily influenced by the monetary and fiscal stimulus policy responses. A global pandemic certainly qualifies as a large shock and has resulted in massive fiscal and monetary policy responses. Potentially complicating matters is the fact that huge increases in public debt and central bank balance sheets were not simply a U.S. response. The same playbook was used by many others across the globe. While there is a general consensus that such actions were appropriate under the circumstances, that does not change the likelihood that those actions may have long-term implications.

To be clear, we aren’t economists or attempting to forecast future inflation rates. Rather, our goal is to point out that future inflation rates could look very different than they do today and that investors need to begin to consider what that might mean down the road for their wealth and investment portfolios.

Why It Matters

A change in inflation rates would likely have implications that reach far beyond just what we pay for every day items like a bottle of milk or a gallon of gas. Such increases are obviously important and impactful, of course, but for investors there is the very real risk of major changes to financial asset prices.

The disinflationary period that began in the early 1980s has allowed investors over the last 40 years to enjoy a strong bull market in bonds. The BarCap U.S. Aggregate Bond Index has returned an annualized +7.5% since 1980, with only three negative years (the worst being down just -2.9%). Falling levels of inflation over that period resulted in an accompanying drop in bond yields that investors sought or accepted when purchasing bonds. Bond prices move in the opposite direction of bond yields, so falling yields translated to higher bond prices and returns. The risk is that if inflationary trends were to reverse and move higher, the opposite would occur. Higher inflation translates to higher bond yields, but lower bond prices and what has been a steady source of returns for investors and portfolios for nearly 40 years could disappear or even become a drag on future portfolio returns.

Before turning our attention to the potential impact on stock prices, we should also point out that higher bond yields would have significant consequences for government deficits (and as a result taxes). Low current interest rates and bond yields have allowed governments around the globe to increase debt levels without a commensurate increase in interest or financing costs. In layman’s terms, they’ve been able to borrow money at such low rates that the cost of that debt or the budget implications have been manageable. That math would change for the worse should inflation cause bond yields to rise.

The impact of higher inflation on stock prices is a bit more nuanced. The impact to individual companies would vary significantly and small or gradual increases to inflation are probably even positive for many businesses revenues and earnings. Outside of the risk that inflation presents to businesses operating metrics, the bigger risk for investors may have more to do with valuation levels. Similar to the impact that falling inflation had on bond prices, stock valuations have also moved higher. As we’ve said on many occasions over the last few years, stock valuations may be high compared to historical stock valuations, but compared to bonds they are still reasonably priced. That dynamic has helped support stock market gains in 2020, but again that could reverse if inflation and bond yields move higher. Said more simply, if low interest rates can push stock valuations higher, then higher interest rates (caused by higher inflation) can push stock valuations and prices lower.

What Are Investors To Do?

As we think about the asset classes and strategies that might benefit from a rise in inflation or inflation expectations, we are pleased to find that a number of such areas are ones in which we have already allocated capital. We don’t believe that is by coincidence. The potential “winners” in a period of rising inflation are also the ones that have benefitted less from (or even been hurt by) the long period of disinflation or low rates. As a result, their valuations are more attractive. Naturally, as valuation focused investors, those areas have garnered increasingly more attention and capital from us the last few years.

The following is by no means an all encompassing list, but some of the major areas that might be expected to do well during a period of higher U.S. inflation include:

The good news for investors is that a change in the direction or level of inflation is far from certain. It is also likely to be several years in the future. The exogenous shock of the pandemic and the resulting policy responses do raise the probabilities that we could see a shift, but the global economy will take time to heal and likely push out inflationary pressures. Investors may not need to take action in the near term, but we still believe it wise to consider the possibilities and plan ahead.

Our Deeper Dive highlights noteworthy and newsworthy items in the past twelve months. To read our 2020 year-end summary click here.

As always, each advisor at Smith and Howard Wealth Management is available and eager to answer your questions on these or other topics related to investments and financial planning. Please call us at 404-874-6244 or email us here.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.