Looking for trends in quarterly returns is typically not advisable or even worth the time. Returns over short periods can be volatile and often uncorrelated, but there are periods where trends can be detected or even rather obvious. As we illustrated in our review of equity markets it appears that returns have moderated from the breakneck pace that investors enjoyed during the initial market recovery that began in the spring of 2020. To use an industry term “the easy money has been made”.

The term “the easy money has been made” is a financial industry phrase typically used in hindsight well after a market has bottomed and investors wise or patient enough to have remained invested have experienced a significant percentage gain off of that bottom. The recovery off of the March 2020 lows appears to fit that pattern, but I’m not sure there are many investors who would consider any of the last 18 months as “easy”!

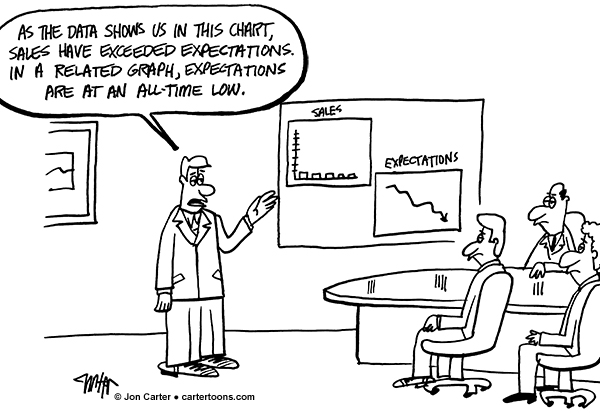

Regardless of how “easy” any of the recent returns have been or are considered, the phrase also implies that returns going forward will no longer be “easy”. That is a sentiment we’d agree with. The exceptional returns of stocks and even bonds since the market lows has exceeded most investors expectations, but with that comes higher valuations. As value oriented investors, we understand that increasingly expensive valuations historically have preceded periods of lower returns. So, like the presenter in the cartoon, our charts showing returns (sales) that exceeded expectations is indeed related to our lower expectations going forward. Lower expectations doesn’t necessarily portend negative returns, but we do expect things to not be as “easy” going forward.

As always, each advisor at Smith and Howard Wealth Management is available and eager to answer your questions on these or other topics related to investments and financial planning. Please call us at 404-874-6244 or email us here.

Our video segment, On The Horizon, highlights government spending, the debt ceiling and inflation. To read our third quarter Market Recap + Outlook, click here.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Back to Insights

Back to Insights