Market Summary | Second Quarter 2021

by: Smith and Howard Wealth Management

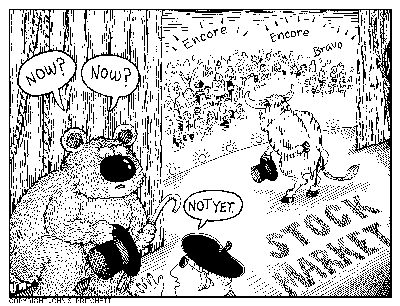

Like many investors, we have been impressed and even a little surprised by the continued and consistent strength of financial markets over not just the last quarter, but since the end of the pandemic related selloff. As welcome as those returns have been, it is no surprise that investors are now wondering if or when we might see a pullback or selloff. It is certainly not an unreasonable concern, as financial markets are well known for their cyclicality and for reversals after strong market moves (up or down).While there is little question that eventually financial markets will experience a down period, we would caution investors on attempting to time markets or expecting anything imminent. Valuations are a poor market timing tool and there are reasons to not panic in that regard. In addition, financial markets, most notably equities, have historically done well (regardless of valuations) during periods in which the economy expands – something that is highly likely given current reopening trends and the low economic bar set during 2020.

Market volatility and “bear” markets are a reality of investing, so we’re sure the bear in our cartoon will eventually make an appearance. It’s impossible to know when that will occur or even how long it will last. For now, all we can do as investors is remain disciplined and prepared, so that we are better able to take advantage of future volatility and opportunities.

As always, each advisor at Smith and Howard Wealth Management is available and eager to answer your questions on these or other topics related to investments and financial planning. Please call us at 404-874-6244 or email us here.

Our video segment, On The Horizon, highlights changes in inflation and tax policy. To read our second quarter Market Recap + Outlook, click here.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.