Market Recap – Economic and Geopolitical Concerns Impact Markets | Fourth Quarter 2018

by: Smith and Howard Wealth Management

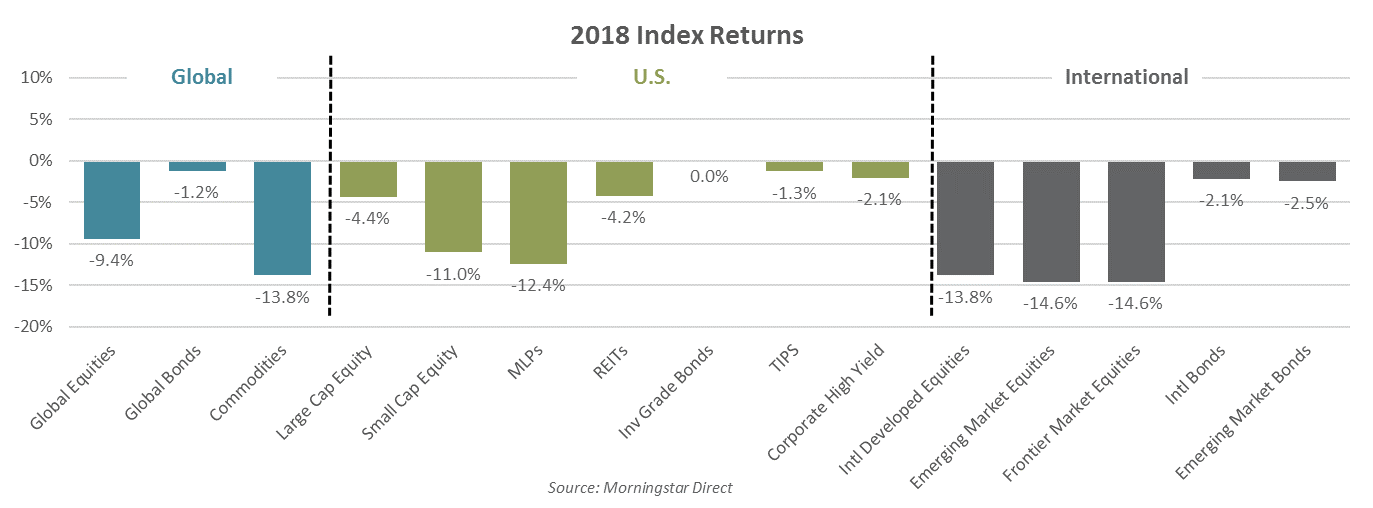

In a nutshell: The past year will be remembered as a year in which nearly every major asset class and market posted a negative return. Global equities fell sharply during the 4th quarter with most major markets entering bear market territory (20% or more below their 52-week high) in December, before recovering some ground prior to year-end. Investment grade bonds did finish up for the quarter and flat for the year as investors sought a haven from volatile equity markets. Commodities, save for gold and precious metals, also dropped precipitously during the last quarter due to a mix of troublesome economic and geopolitical news.

For an in-depth look at the market for the quarter just ended, read below.

While markets had experienced periods of volatility throughout the year, returns through the first nine months of 2018 had been relatively flat. Mounting economic and geopolitical pressures during the 4th quarter, however, resulted in a further pickup in volatility and drove the returns of most major asset classes and markets into negative territory. Only U.S. government bonds and gold provided U.S. investors with any protection against the global selloff. U.S. equity markets remained ahead of international markets for the year but underperformed during the most recent quarter. While global bonds were negative, U.S. investment grade bonds did manage to finish flat on the year after a year-end recovery helped erase losses experienced earlier in the year.

Equities

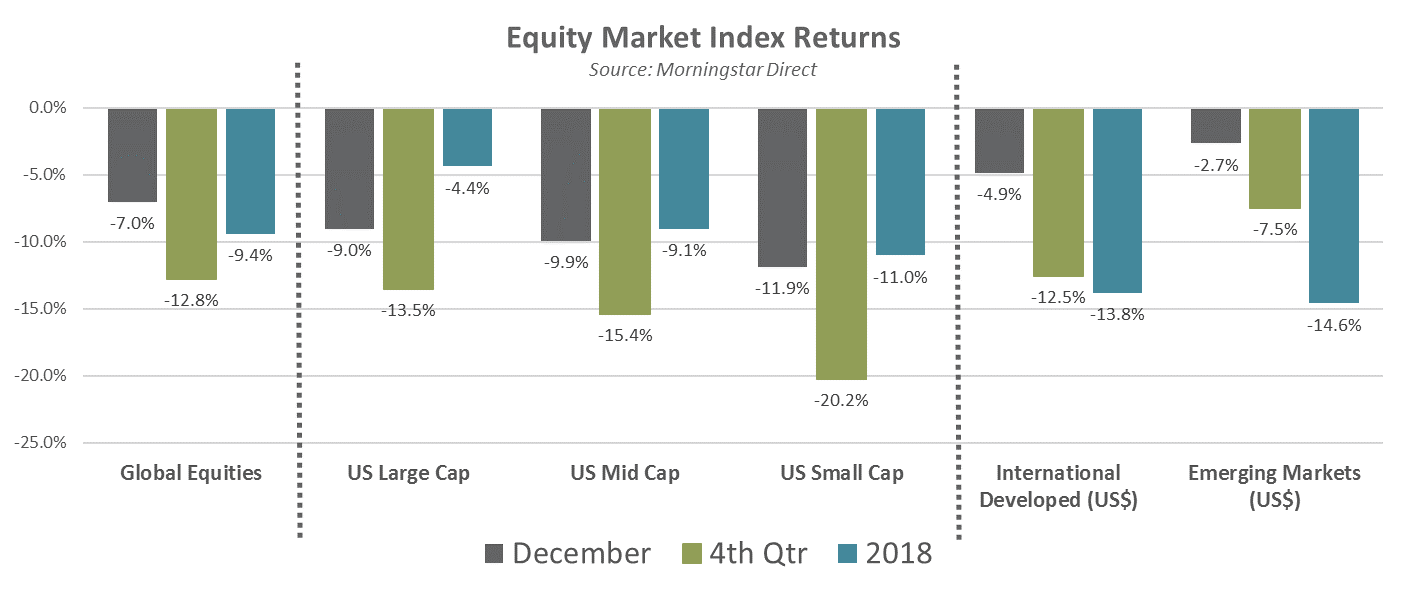

The 4th quarter started off on a positive note with the S&P 500 Index reaching a new all-time high on October 3rd. It did not take long, however, before investor sentiment shifted, causing equity markets to dramatically reverse course. While returns for the quarter were negative through November, the selloff intensified during December due to a variety of economic and geopolitical concerns. For the quarter, the global equity market (as represented by the MSCI All Country World Index) returned -7.0%, which resulted in full-year returns of -9.4%. Most major global equity markets, including those in the U.S., reached “bear” market territory during the quarter, meaning that they had fallen more than 20% from their 52-week high.

Possible Causes for Weakness: The Fed, China trade relations, and political rhetoric

Weakness during the quarter was the result of concerns that primarily originated in the U.S. Those concerns caused U.S. markets to underperform both international developed and emerging market equities, particularly in December. Investors appeared to be unnerved by the Federal Reserve continuing to raise interest rates despite signs that U.S. economic growth was slowing (albeit from a very strong pace). The Federal Reserve did indicate that they were close to being done with their rate hiking cycle, but that did little to calm investor concerns. It did not help that the communication from the Federal Reserve happened to occur at roughly the same time that political rhetoric over government spending and the border wall were heating up. While such politically driven items typically don’t have a meaningful economic impact, they can certainly weigh on markets and investor sentiment in the short term.

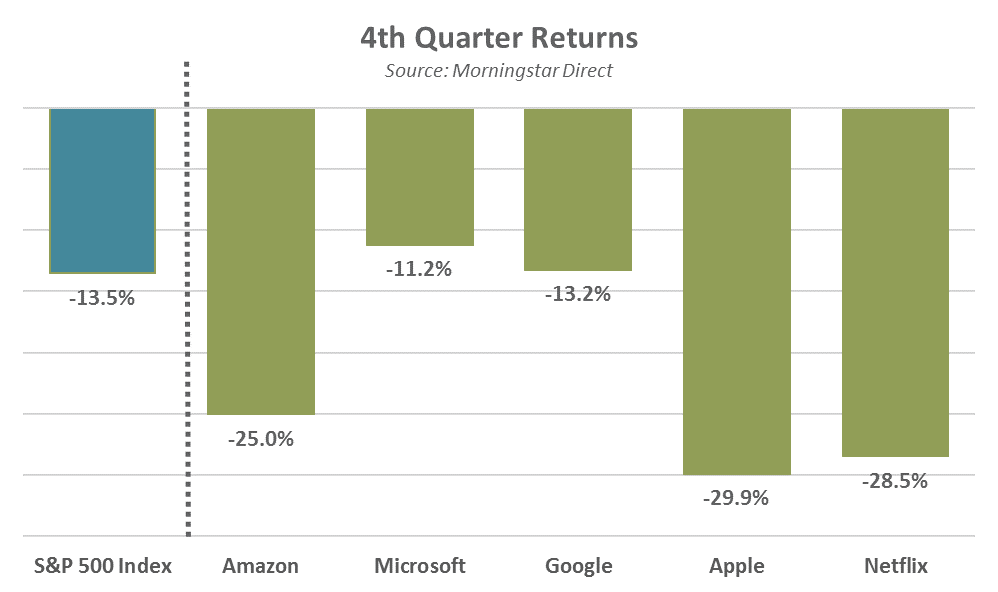

Last quarter we mentioned the increasingly narrow nature of the advancing U.S. equity markets. By “narrow” we mean that advances in the overall market were being driven by just a small handful of stocks, notably Amazon, Microsoft, Google, Apple, and Netflix. As the accompanying graphic illustrates, that trend reversed sharply with three of the stocks falling quite a bit more than the S&P 500, while two fell roughly in-line with the index.

Bonds

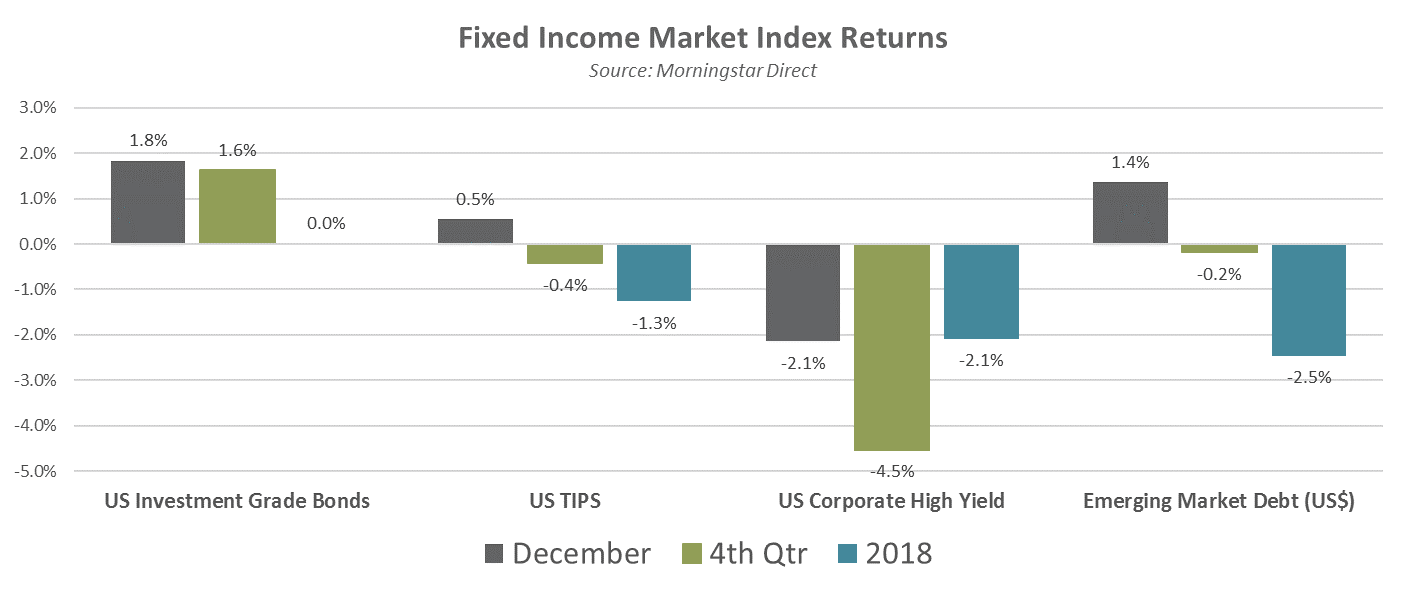

Investors, in a flight to perceived safety amid the bear market conditions in equities, moved money to fixed income during the quarter. The 10-Year U.S. Treasury yield began the quarter around 3.07% but finished the quarter at just 2.69%. Yields are inversely correlated to bond prices, so falling yields increased bond prices and resulted in the benchmark bond index (Barclays U.S. Aggregate) returning +1.6% for the quarter. Despite the gains during the quarter, the benchmark managed to only return to flat for the year with a return just slightly above 0.0%. While investment grade bonds posted positive returns for the quarter, non-investment grade bonds (as represented by U.S. Corporate High Yield) fell -4.5%. The weakness was the result of widening credit spreads that more than offset the benefit from falling treasury yields.

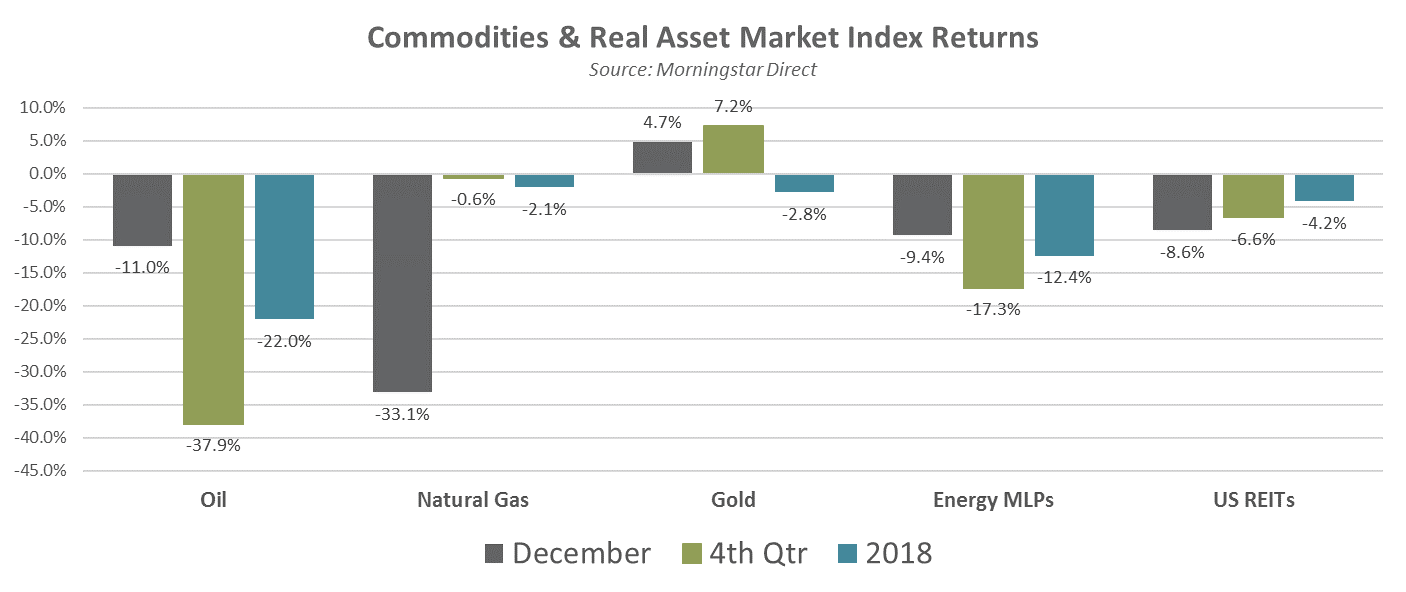

Real Assets – Commodities and REITs

Commodities and real asset related strategies saw some of the most significant moves during the quarter. Like bonds, gold prices are often lifted by equity market instability. That was evident during the 4th quarter as gold returned a positive +7.2%. More cyclical commodities, such as oil and natural gas, suffered a very different fate falling by -37.9% and -0.6% during the quarter. Geopolitical events resulted in oversupply issues in oil at roughly the same time economic concerns were weighing on future demand forecasts. The pressure on both commodities put pressure on Energy MLPs which were further impacted by year-end tax loss harvesting activities. While REITs often benefit from falling U.S. Treasury yields, that was not the case during the quarter as they also fell -6.6%.

To learn more about the economic and geopolitical events that affected the markets, contact Brad Swinsburg 404-874-6244.

Explore more information on the fourth quarter of 2018 by visiting these links:

Market Outlook: Fourth Quarter 2018

On the Horizon: Fourth Quarter 2018

A Deeper Dive: Fourth Quarter 2018

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.