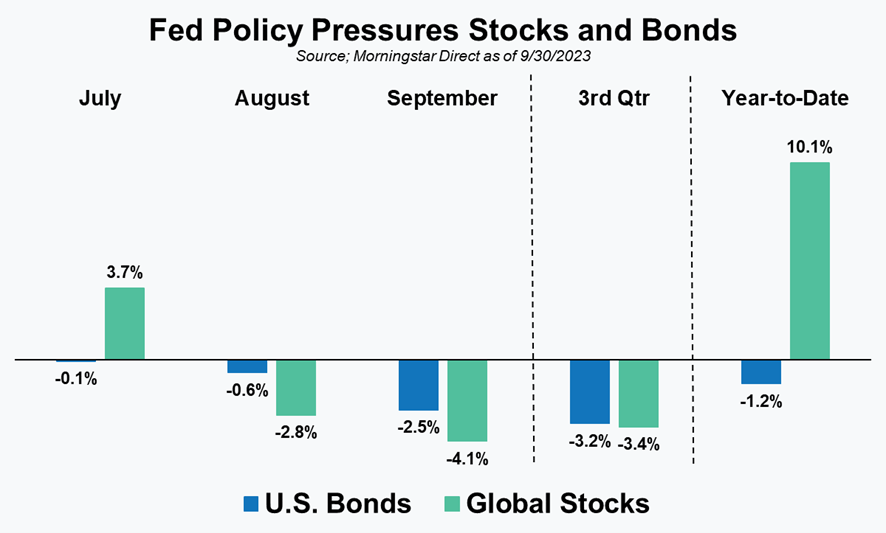

The relief generated by the U.S. debt ceiling resolution in early June allowed stocks and bonds to carry some positive momentum into the 3rd quarter. Both would enjoy additional gains during the month of July, but unfortunately those gains would be short-lived. For equities that would largely result in giving up only a portion of year-to-date gains, but for bonds the ensuing two months would flip returns for the quarter and year-to-date period from positive to negative.

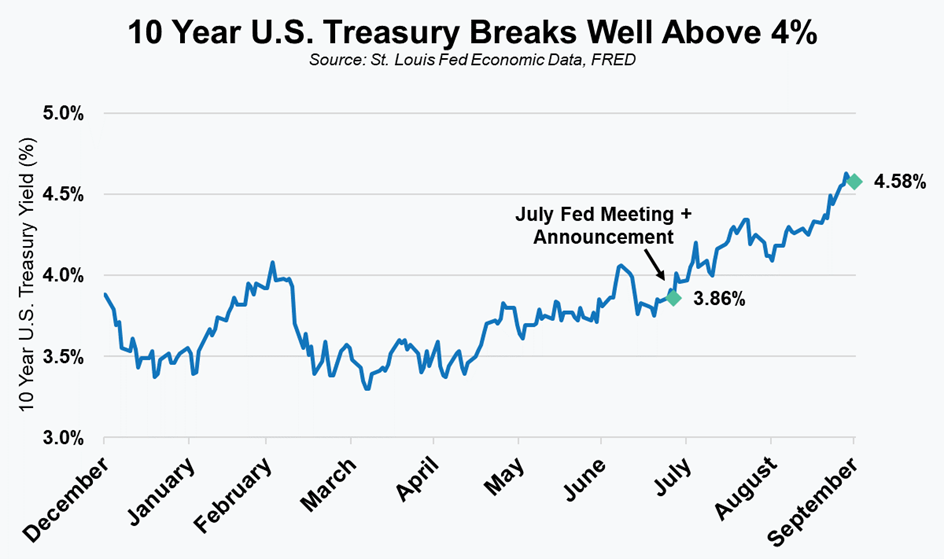

The actions and communications of the Federal Reserve (the Fed) have weighed heavily on markets for much of the past two years and late July would be another example of that influence. The Fed’s July meeting and rate hike announcement (July 26th) appeared to be a key turning point for market sentiment and direction. While their rate hike of 25 basis points (0.25%) had been expected, their communication about future actions appeared to disappoint investors. Not only did they signal that they may raise rates again during 2023, but they also expressed an expectation that rates might need to stay higher for longer. That “higher for longer” assertion had not been as widely expected and diverged from what markets had priced in at that point.

Equities

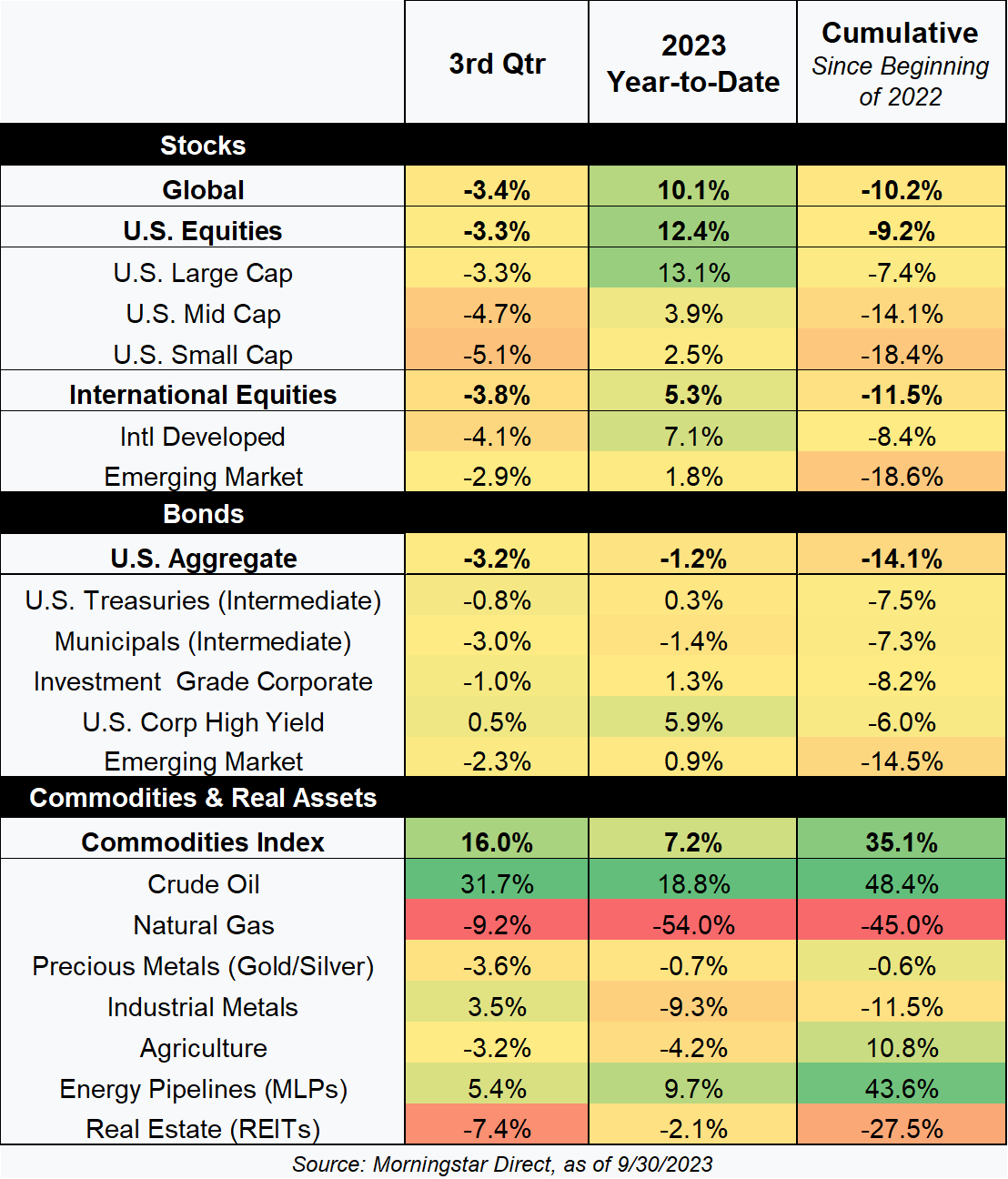

While there is always a bit of divergence or variance, as our Heat Map showed, equities broadly lost ground during the quarter. Fortunately, as that table also shows, they remain up nicely for the year-to-date period. The driver of the recent weakness was reminiscent of what we experienced for much of 2022 – higher interest rates and bond yields putting pressure on equity prices. That pressure was enough to counter positive developments on economic growth as the much-anticipated recession has yet to come to fruition.

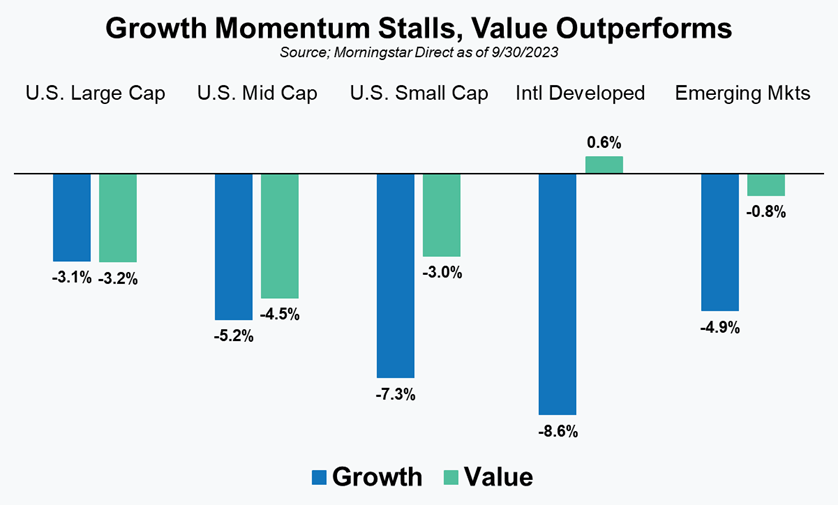

In addition to experiencing modest weakness for the first time since the 3rd quarter of 2022, we also saw a shift in one dynamic that we’ve highlighted before – the divergence in returns between growth and value stocks. After a strong run for value stocks in 2021 and most of 2022, growth stocks had enjoyed a resurgence for much of this year. While there was no real difference within U.S. large cap stocks and growth generally remains well ahead for the year, that trend reversed a bit in the most recent quarter, especially in international markets. Given our valuation driven positioning that value stocks represent a better opportunity this was a welcome and noteworthy development.

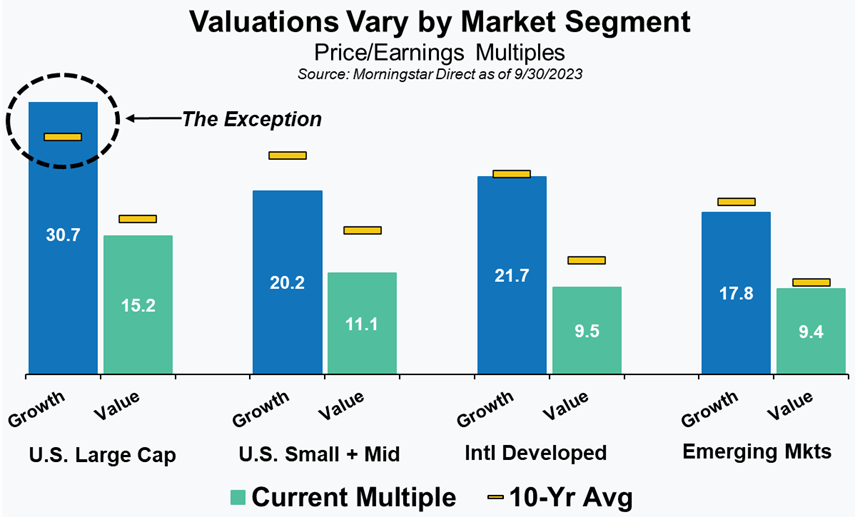

With equities falling broadly, our view on valuations and the areas for opportunity has not materially changed. We continue to believe that valuations favor value stocks, middle and small capitalization companies, and international markets. As our market multiples graph shows, those markets remain at valuations that are below where they’ve been over the previous 10 years. The only markets that don’t fit that profile and hence we remain wary of are U.S. Large Cap and specifically U.S. Large Cap Growth.

As a result, when clients ask us our opinion on equities our answer is often “it depends”. Our bigger picture view is that equities appear fair to even cheap in most segments, but there are also outliers on the more expensive side that give us pause.

Fixed Income

After appearing to stabilize the past few quarters, volatility returned to fixed income and resulted in bonds giving up all their gains from earlier in the year. As mentioned previously, and shown in our graph, the turning point came in late July after the Fed meeting. Up to that point, while there had been plenty of movement in bond yields, most of that movement had been sideways as yields were flat compared to where they began the year. Over the course of August and September, however, yields would surge higher as the yield on the 10-Year U.S. Treasury bond increased by 0.72% moving from 3.86% the day of the Fed rate hike announcement (July 26th) to 4.58% by September 30th.

An increase of that magnitude in yields across the yield curve can be a formidable headwind for bond investors, but the news was not all negative for the quarter. Credit focused strategies, where investors own bonds of lower credit quality bonds in exchange for higher expected returns, held up better than government bonds. As shown in our “Heat Map”, corporate high yield even managed to eke out a gain for the quarter and remains up nearly 6% for the year.

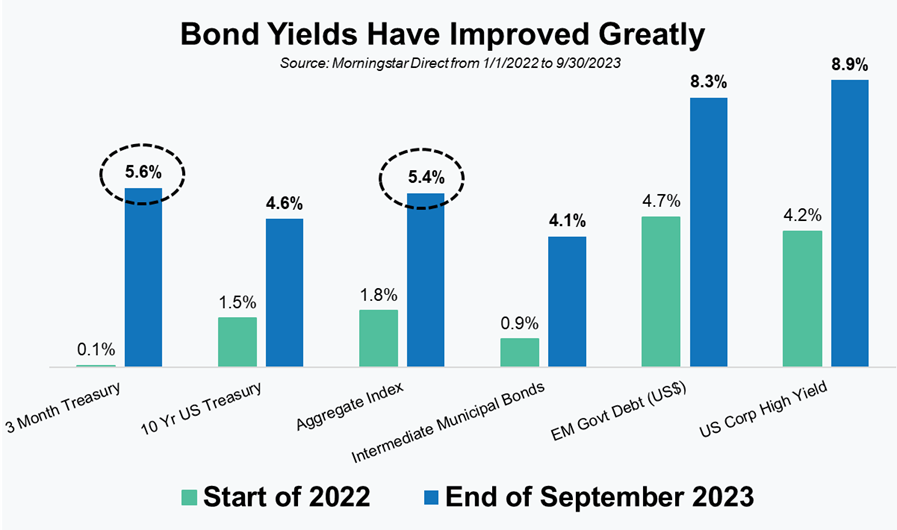

Attractive cash yields and negative bond market returns continue to keep many investors on the sidelines (in cash). We understand their hesitation to shift from the safety and current yield of cash, but believe investors will ultimately regret not locking in what are increasingly attractive yields on intermediate maturity bonds. The reason or the rationale won’t be obvious to most investors who focus strictly on current yields and have a timeframe of the next few months. For example, as can be seen in the following graph the current yield-to-maturity for a cash equivalent like a 3-month U.S. Treasury bond is 5.6% (blue bar) while the blended yield to maturity for the core U.S. bond benchmark stands at 5.4% (blue bar).

Why would an investor purchase a bond with a yield-to-maturity that is less than they could get through a short-term Treasury or cash? The answer is because the cash yield may end up being a fleeting “here today, gone tomorrow” proposition. Investing in a strategy or fund that looks more like that intermediate bond benchmark allows the investor to have a greater degree of confidence of what their return is likely to be over a longer timeframe. Additionally, if (or when?) interest rates do come down, bonds that mature several years out will experience some level of immediate price appreciation. Given that the scenario where rates fall likely coincides with a tough environment for the economy and stocks, that may help a diversified investor better weather that period. No, cash won’t lose money during a period of falling rates, but it also won’t offer the same level of protection or benefit that bonds likely will.

The path of interest rates and bond returns that led to today’s yields has been painful, but with the Fed nearly done hiking rates and inflation receding we think investors should feel encouraged about return prospects moving forward. The change in yields over the last 21 months has been significant and can be seen in that previously shown comparison of yields at the start of 2022 with where they are now (compare the mint green bars with the blue bars). While we understand investors frustrations with bond returns over the past few years, current yields are finally at reasonably attractive levels which leads us to be more positive on future returns, not less.

Commodities + Real Assets (+ Alternatives)

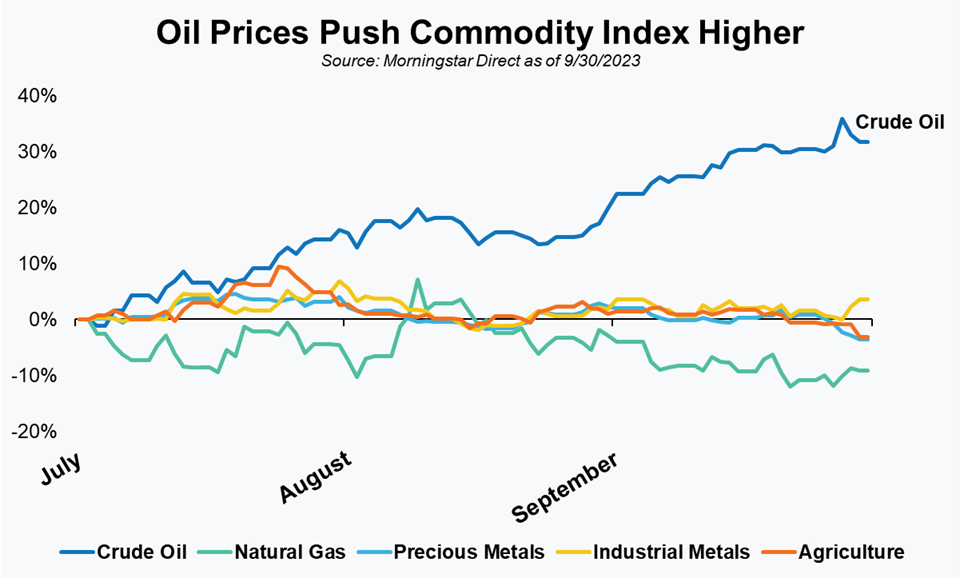

Commodities and real assets, at least the ones we typically track and view as investable, fared better during the quarter than traditional stocks and bonds. As shown in our returns Heatmap, the broad commodities index was materially positive with a return of +16%. That figure is a bit deceiving, however, as that was driven almost entirely by a spike in Crude Oil during the quarter.

Oil prices have jumped higher over the last few months due to continued strong demand coupled with supply cuts by OPEC+. OPEC+ countries, most notably Russia and Saudi Arabia, extended planned productions cuts through November and are now holding back 4 million barrels of crude oil supply per day. That represents the largest non-recession related cuts to production in the last two decades. Fortunately, most market participants expect some of the price pressures to ease due to the end of the summer travel season and an increase in production from other suppliers like the U.S., Canada, and potentially Iran.

As the chart shows, however, oil was the lone positive outlier. Most of the other major commodity segments were relatively flat and the other major energy component, Natural Gas, was down.

As for some of the other real assets that we focus on, the strength in oil was a tailwind for Energy Pipelines as they enjoyed a pleasantly solid gain for the quarter. REITs were not as fortunate, however, as their interest rate sensitivity was again on display as rising rates led to a quarter that erased all their year-to-date gains.

From a big picture standpoint, Commodities, Real Assets, and Alternatives more generally, continue to display the attributes that we believe make them important components of a diversified portfolio. Most importantly, their ability to deliver less correlated returns during a period of time when traditional stocks and bonds experience losses. Not every commodity or real asset enjoyed gains, of course, but they also didn’t simply “follow suit” with stocks and bonds.

As always, our team of advisors is available and ready to answer your questions on these or other topics related to investments and financial planning. Please call us at 404-874-6244 or email us here.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Back to Insights

Back to Insights