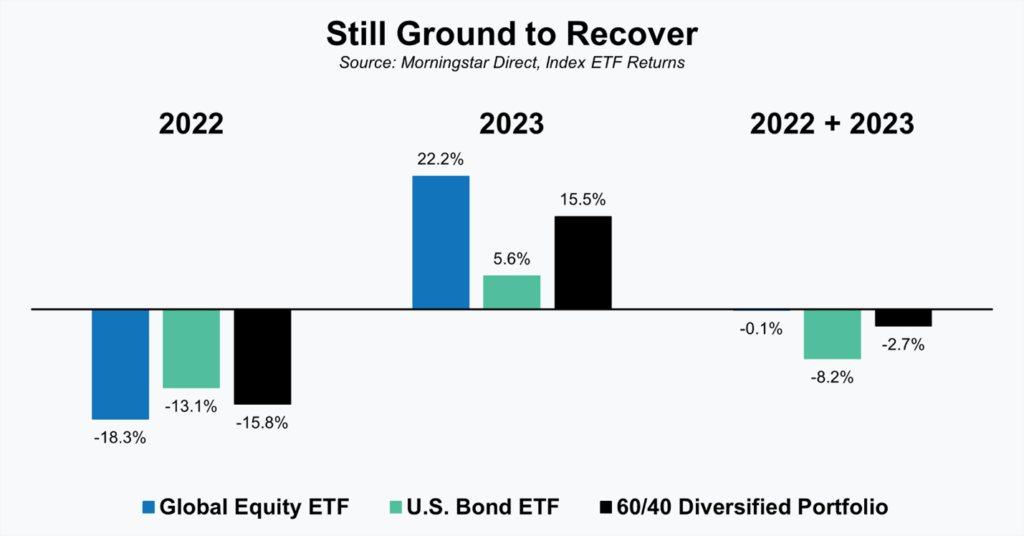

What a difference a year makes. After a difficult 2022 in which both stocks and bonds experienced double-digit percentage losses, 2023 proved to be a much more positive experience for investors. Both stocks and bonds enjoyed a solid recovery, but as is typical, the results don’t tell how the story developed. In fact, as we reflect on not just the past quarter and year but the past two years, a couple of things stand out.

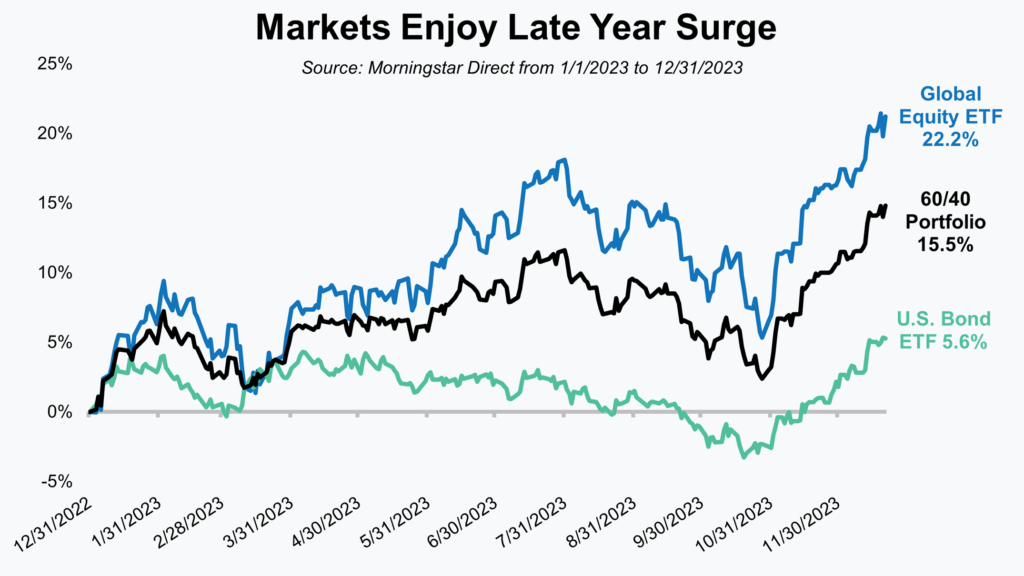

The past two months made the entirety of 2023 look better

The end results may be all that ultimately matters, but the picture wasn’t quite as rosy a mere two months ago. Bonds were negative on the year and stocks had given up much of their early-year gains. After a good start to the year, the Fed’s “higher for longer” rate talk in late July had led to a three-month market swoon. As inflation data continued to improve into the fall of 2023, however, it became increasingly clear that the Fed was likely done hiking rates and could possibly even start looking at cutting rates in 2024. As a result, stocks and bonds surged higher into year-end. Maybe we should revise our opening sentence to “what a difference two months make”!

Happiness or Relief?

Investors are undoubtedly feeling better about things as compared to 12 months ago, but we suspect most feel more relieved than happy. Despite the strong results of the past year, a typical diversified portfolio (which is to say most investor portfolios) has yet to return to where it was two years ago before markets began their selloff. Unlike most selloffs in recent memory, the primary culprit for that has been bonds. As the illustration below shows, while stocks are close to having recovered their prior year losses, bonds remain underwater.

Equities

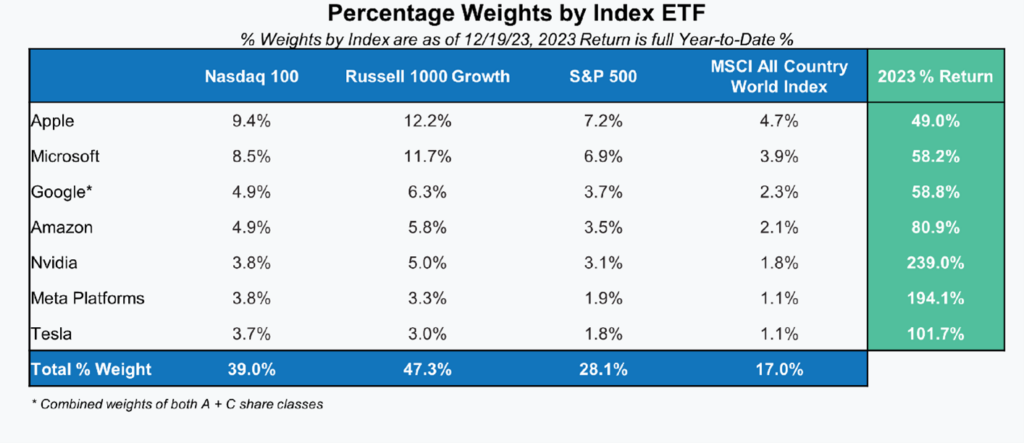

Investors who tune into any of the financial media shows are surely familiar with the FAANG acronym from a few years ago. The term was coined as a quick reference to five stocks, each represented by the first letter of their company name, that were the source of a large portion of market returns. Naturally, as some stocks fade and others emerge, the financial industry and media search for new, clever ways to describe some of the top-performing stocks. During 2023, we saw the rise of the “Magnificent Seven”.

The seven stocks that comprise the “Magnificent Seven” are shown in the table below and discussed in one of our videos this quarter. Still their impact was so significant over the past year that any discussion about the equity market would not be complete without digging into their impact.

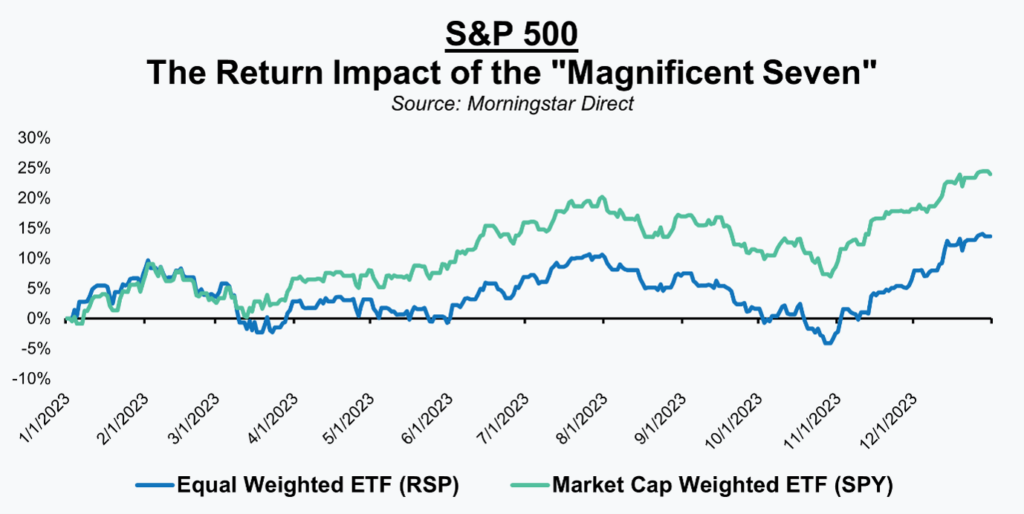

Just how big was their impact? Let’s look at two different Exchange Traded Funds (ETF) based on the stocks in the S&P 500. In our graph below, the mint green line shows the performance during 2023 of a market cap-weighted index ETF (ticker SPY). Market cap-weighted simply means that the larger the company, the larger its impact on the index. The “Magnificent Seven” make up nearly 30% of that index. The blue line is an equal-weighted index ETF of the same exact stocks. Due to the equal-weighted nature of this index, the impact of the “Magnificent Seven” is greatly diminished. They are reduced from a 30% weighting in the market cap-weighted index to closer to 1.5% when equal-weighted. The difference is remarkable. As strong as equity markets were during the year, much of that can be directly attributed to just a handful of U.S. large cap tech stocks.

Before we get too carried away admiring the tremendous results of the Magnificent Seven, we should point out that their incredible 2023 came on the heels of a disastrous 2022 in which the average return of the seven names was -46%.

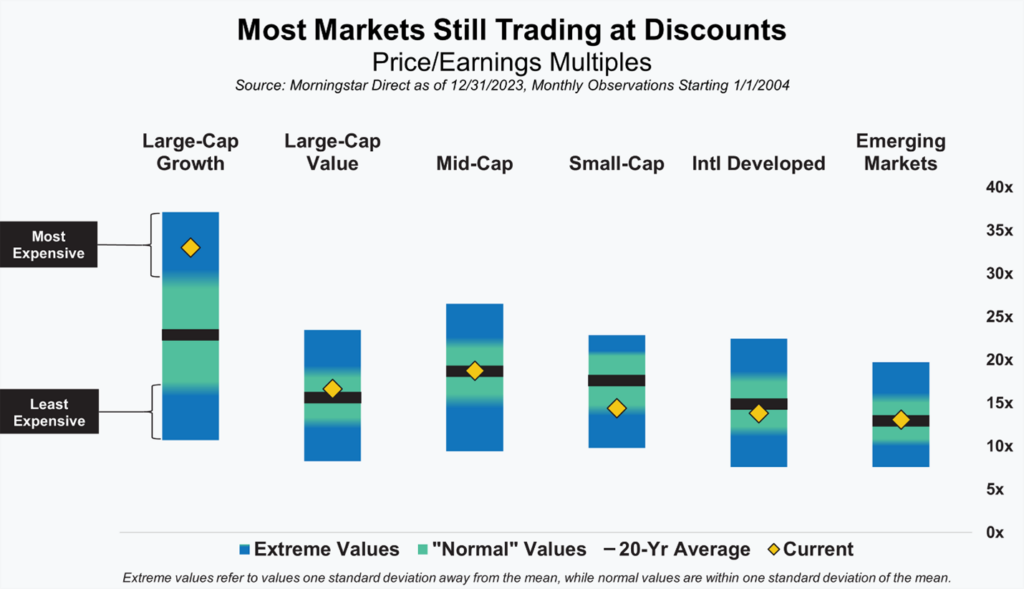

One positive that comes with having such a small number of stocks driving most of the returns is that material differences in valuations emerge or persist. For a capital allocator who sees opportunity in such divergences, like we do, it’s not an unwelcome development. It’s an opportunity, and the larger the divergence, the greater the opportunity. Despite the strong market returns of the past 12 months (15 months going back to the lows of 2022), we still see a number of pockets of opportunity. As our illustration shows, most markets remain at fair to somewhat attractive valuations. Only U.S. Large Cap Growth, dominated largely by the Magnificent Seven, has valuations meaningfully above average.

As a result, when clients ask us our opinion on equities, our answer is often “it depends”.

Fixed Income

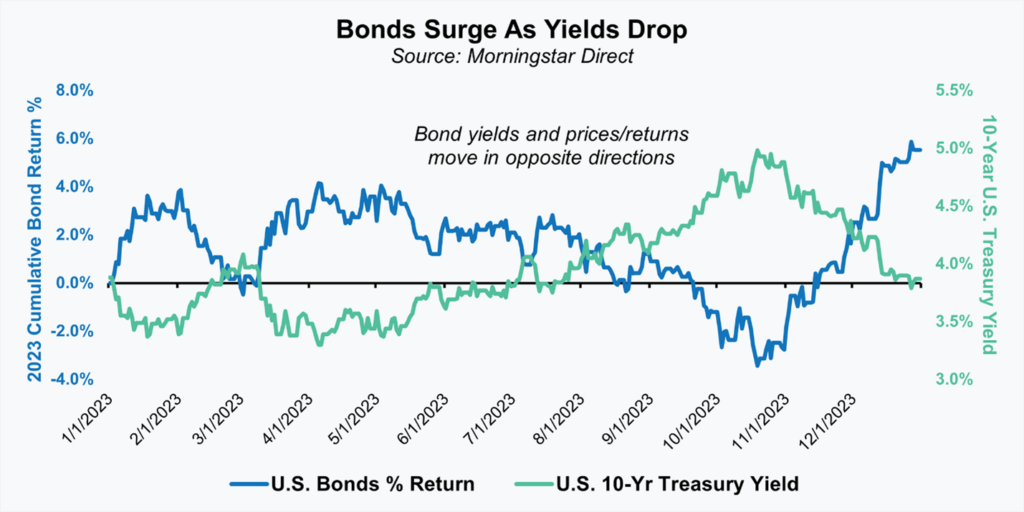

Fixed income investors may have been the most relieved by the financial market rally into the end of the year. After spending the first nine months of the year in positive territory (blue line in the graph below), bonds fell back into negative territory for the year as the Fed’s communications caused yields to rise (mint green line). Faced with potentially a third straight year of negative returns on bonds, investors were again questioning why they owned them at all.

As we know now, better inflation data, no additional rate hikes, and more “dovish” communications from the Fed sparked an end-of-year market rally in which bond yields dropped and bond returns improved tremendously (bond yields and bond prices/returns move in opposite directions). Interestingly, despite a lot of volatility and movement in yields during the course of the year, the 10-year U.S. Treasury bond ended the year with nearly the exact = yield that it started the year (3.88% vs 3.87%).

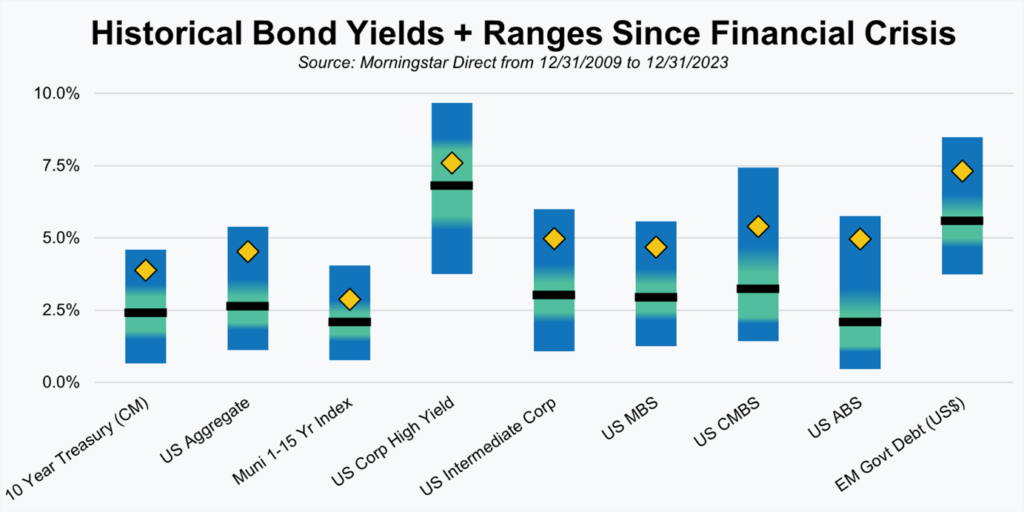

The flip side of the recent rally for bonds is that yields, which closely align with return expectations, are now lower than they were a few months ago. While not as attractive as they were at the end of October, they are still more attractive than they’ve been at almost any point since the great financial crisis.

We recognize that the last few years have been difficult for bond investors, but if yields closely align with return expectations (as we believe and as history proves), then investors should be encouraged about future return expectations. With the Fed likely done hiking rates, and yields now higher, we’re optimistic that for the first time in a very long time, bonds can pull their weight as part of a diversified portfolio.

Commodities + Real Assets + Alternatives

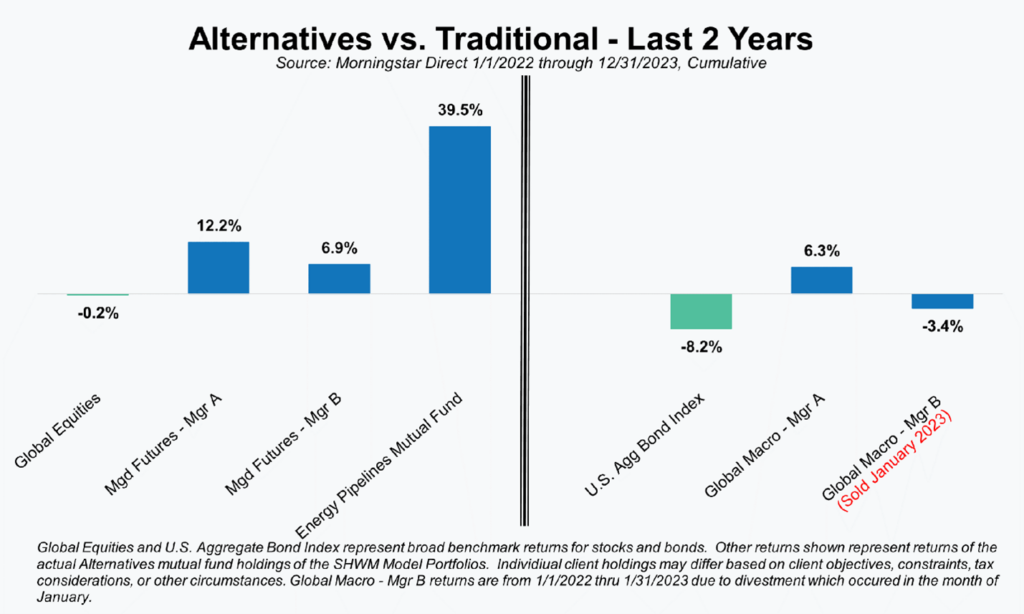

With equities having largely recovered their 2022 losses, we thought it would be a good time to revisit how the alternative strategies that we favor have fared over the last two years. As our investors know, we tend to gravitate toward alternative strategies that have low correlations with traditional stocks and bonds. While there is never any type of guarantee, our expectation is that these strategies will fare better than those traditional markets during a downturn – 2022 being a perfect example. Conversely, those strategies may underperform when markets are strong – like this past year.

Those expectations were largely met over the last two years. But how did they fare over the full two-year period or as equities came full circle?

Thankfully, they fared rather well. Not only did they perform admirably during the downturn, but they also did not simply give back that outperformance as markets recovered. That isn’t to say they didn’t give back some outperformance, but as shown in our illustration the cumulative returns over the last two years handily outpaced that of traditional stocks and bonds.

I’ll also note that this doesn’t account for some of the opportunistic allocation changes we made over the last two years. Those changes would only have increased the value-add or differential. As a quick recap, as 2022 unfolded, we incrementally sold some of the alternatives that had performed well to that point to buy some of the traditional markets that had experienced weakness. Then, as traditional markets recovered, we opportunistically reversed a number of those changes.

We know that every market cycle will be different, but we’re happy to report that our approach to and use of alternative strategies helped add value during a difficult period for investors.

As always, we welcome questions or comments, and an opportunity to talk through your financial situation. Please call or email me or anyone on our team.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Back to Insights

Back to Insights