On February 23, 2022, the IRS issued Proposed Regulations to provide guidance on ambiguous language and rules on inherited retirement accounts contained in the SECURE Act of 2019. It is important to note that the Proposed Regulations are likely to be amended in some form or fashion. Our discussion focuses on non-eligible designated beneficiaries of retirement accounts and related distribution rules – an ongoing concern for many.

What is a Non-Eligible Designated Beneficiary?

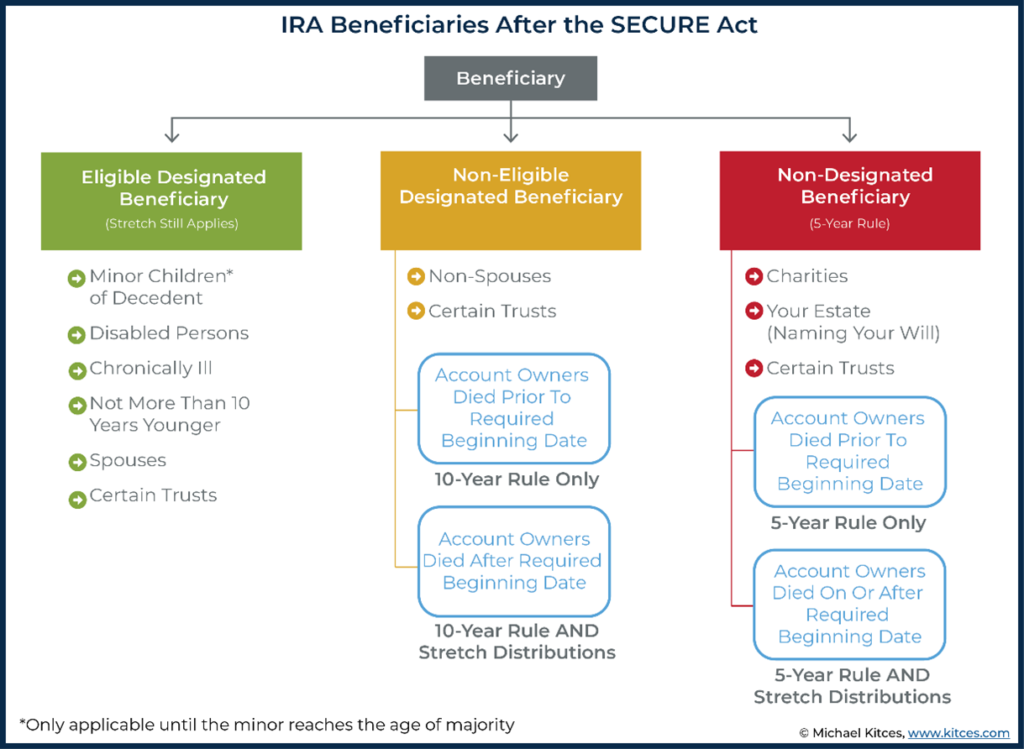

A non-eligible designated beneficiary under the SECURE Act is a non-spouse or certain trusts. This is an important distinction as you read the proposed changes to the rules below.

Current Law Under the SECURE Act

For many individuals, the biggest change that came with the SECURE Act was the so called “10-Year Rule.” The rule currently states that most non-eligible beneficiaries of retirement accounts are required to take distributions of 100% of the inherited retirement account by the 10th year from the decedent’s (original retirement account holder) death. Required Minimum Distributions (RMDs) are not currently required for beneficiaries who inherited a retirement account from a decedent who passed after December 31, 2019 during this 10-year “window” as long as the account is fully liquidated by the 10th anniversary of the decedent’s death. If the decedent died prior to January 1, 2020, the non-eligible beneficiaries would continue to take RMDs based on their own life expectancy, stretching the RMDs over their lifetime and taking a mandatory distribution each year. A graphic showing the current layout of beneficiaries and inherited IRAs is below.

New Proposed Regulations

Required Beginning Date

First, the proposed regulations include the Required Beginning Date or RBD in the new rules. RBD marks the point at which owners of certain retirement accounts like IRAs and 401(k)s must begin taking required minimum distributions (RMDs). Typically, this is April 1 of the year after the owner of the account turns 72.

Non-Eligible Beneficiaries: Two Groups

The new proposed regulations seek to separate non-eligible designated beneficiaries into two groups.

Group 1: Individuals who inherit a retirement account from a decedent who died before their Required Beginning Date. These beneficiaries would be subject only to the “10-Year Rule” meaning they must liquidate 100% of the retirement account balance by the 10th anniversary of the decedent’s death. They are not subject to any mandatory annual distributions.

Group 2: Individuals who inherit a retirement account from a decedent who died on or after their Required Beginning Date. These beneficiaries are subject to the “10-Year Rule” and annual, mandatory distributions. Meaning that they will be forced to take a mandatory distribution based on their life-expectancy throughout the 10-year period and liquidate the entire remaining retirement account balance on or before the 10th anniversary of the death of the decedent.

Here’s a hypothetical example should the proposed regulations pass as drafted.

Tyler is the adult child (40 years old) of Robert (73 years old) and Jenny (69 years old). Both Robert and Jenny held separate IRAs. In June of 2022, Robert and Jenny tragically pass away. Robert and Jenny left Tyler as the sole beneficiary of each of their IRAs.

Since Tyler is a non-eligible designated beneficiary (see chart above) and Robert died after his required beginning date (RBD) and Jenny died before her RBD, Tyler will be subject to two different post-death distribution rules as follows:

Jenny’s IRA: The IRA that Tyler inherited from Jenny will simply need to be liquidated by the 10th anniversary of Jenny’s death. This is because Jenny passed away before her required beginning date (age 72). Tyler can take distributions from the IRA during this 10-year period, but it is not required.

Robert’s IRA: The IRA that Tyler inherited from Robert will be subject to the 10-year rule mentioned above and annual mandatory required minimum distributions. Thus, beginning the year after Robert’s death (2023) Tyler will need to start taking distributions from the inherited IRA belonging to Robert, based on Tyler’s life expectancy, and he must liquidate the account in its entirety by the 10th anniversary of Robert’s death.

We are watching the progress of this proposed legislation closely and will follow up with updates as soon as possible. In the meantime, if you have questions about the implications for the current or pending rules on IRAs you have inherited, please contact Michael Mueller or Jeff Brandon.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Back to Insights

Back to Insights