Celebrating the American Worker

by: Smith and Howard Wealth Management

“Somebody once said that in looking for people to hire, you look for three qualities: integrity, intelligence, and energy. And if you don’t have the first, the other two will kill you.” – Warren Buffet

Unlike most U.S. holidays, Labor Day is a celebration without rituals, except for shopping and barbecuing. For most people, it simply marks the last weekend of summer and the start of school.

The holiday’s founders in the late 1800’s envisioned something very different from what the day has become. They were looking for two things: a means of unifying union workers and a reduction in work time. These early organizers clearly won, as the average person working in manufacturing now puts in a bit over 40 hours a week (as opposed to 60 – 70 hours in the late 1800’s) and most people work an average of five days a week (shortened from a 6 – 7 day average workweek). Shortening the workweek was one way of turning the working class into the consuming class by creating more time off to spend wages on traveling, entertainment or dining out. Hence, our consumer-driven economy was ignited.

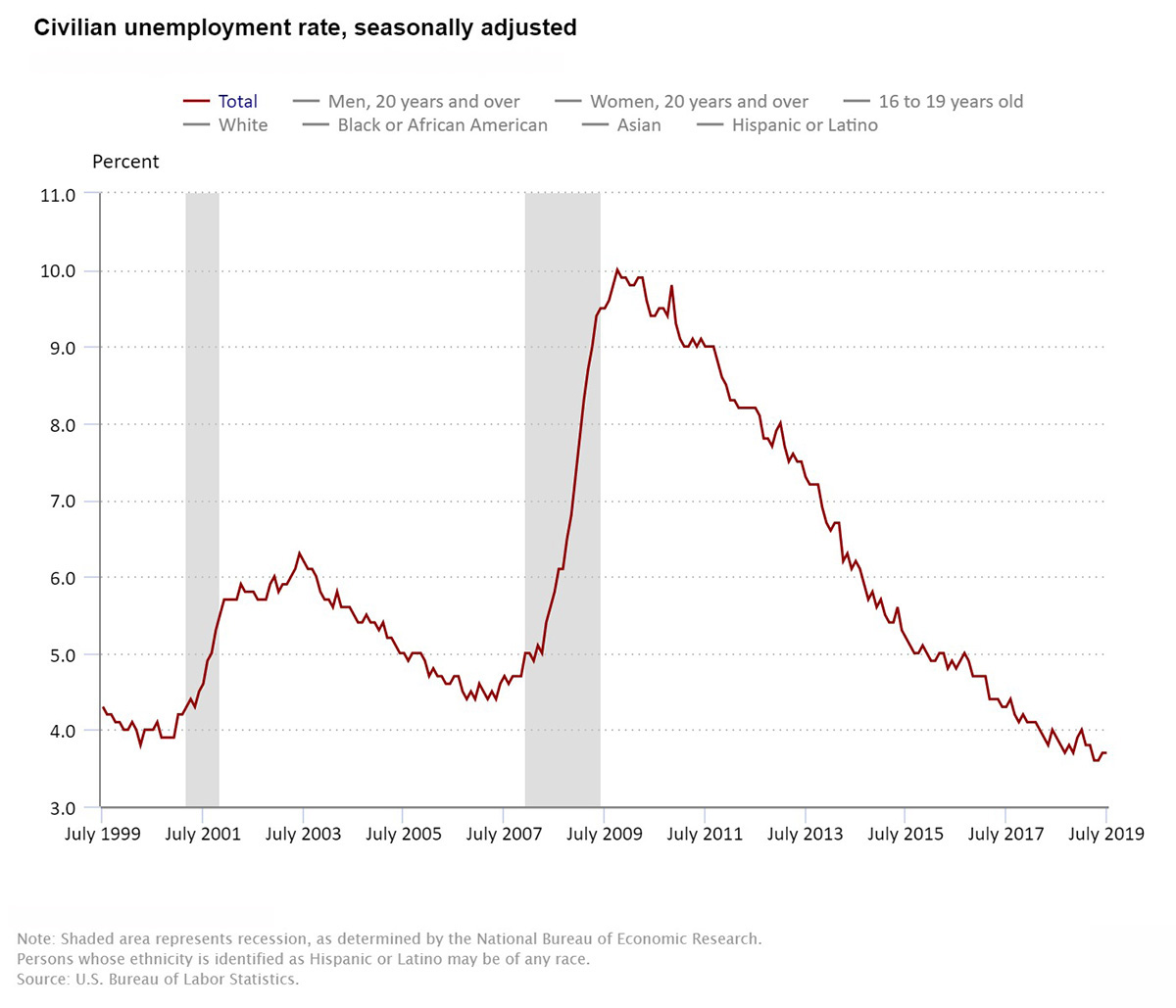

During this Labor Day week, we thought it would be an appropriate time to reflect on the state of the workforce in America and the labor market in general. In a nutshell, the unemployment rate is near the lowest level since the 1960’s, job growth remains robust, and wage growth is picking up. All of this is good news for workers and for those looking for employment.

As noted in the above chart, the unemployment rate was 3.6% in April and May and 3.7% in June and July; I would guess a similar level for August will be released shortly. The last time the unemployment rate was lower was back in 1969. Some will attribute low unemployment to the participation rate (the share of those aged 16+ who are either working or looking for work) which is lower than it was in prior decades. But in 1969, when the unemployment rate averaged only 3.5%, the participation rate was 60%, which is much lower than the 63% average so far this year.

In the past 12 months, the unemployment rate for workers without a high school degree has averaged 5.6%, the African American unemployment rate has averaged 6.4% and the Hispanic jobless rate has averaged 4.5%, all the lowest figures on record for all these groups. These figures indicate the improvement in the labor market has been broad-based.

Another measure of the labor market is the U-6 unemployment rate which includes discouraged workers and counts as unemployed those working part-time who are seeking full-time jobs. The U-6 unemployment rate has dropped to 7%, very close to the record low of 6.8% in October 2000, near the peak of the first Internet Boom.

Meanwhile, job growth remains healthy. After expected downward revisions from the initial Bureau of Labor Statistics’ estimates, job growth will average between 160,000 to 170,000 new jobs per month over the past 18 months. This growth rate is well ahead of the 100,000 new jobs needed per month to keep the unemployment rate steady.

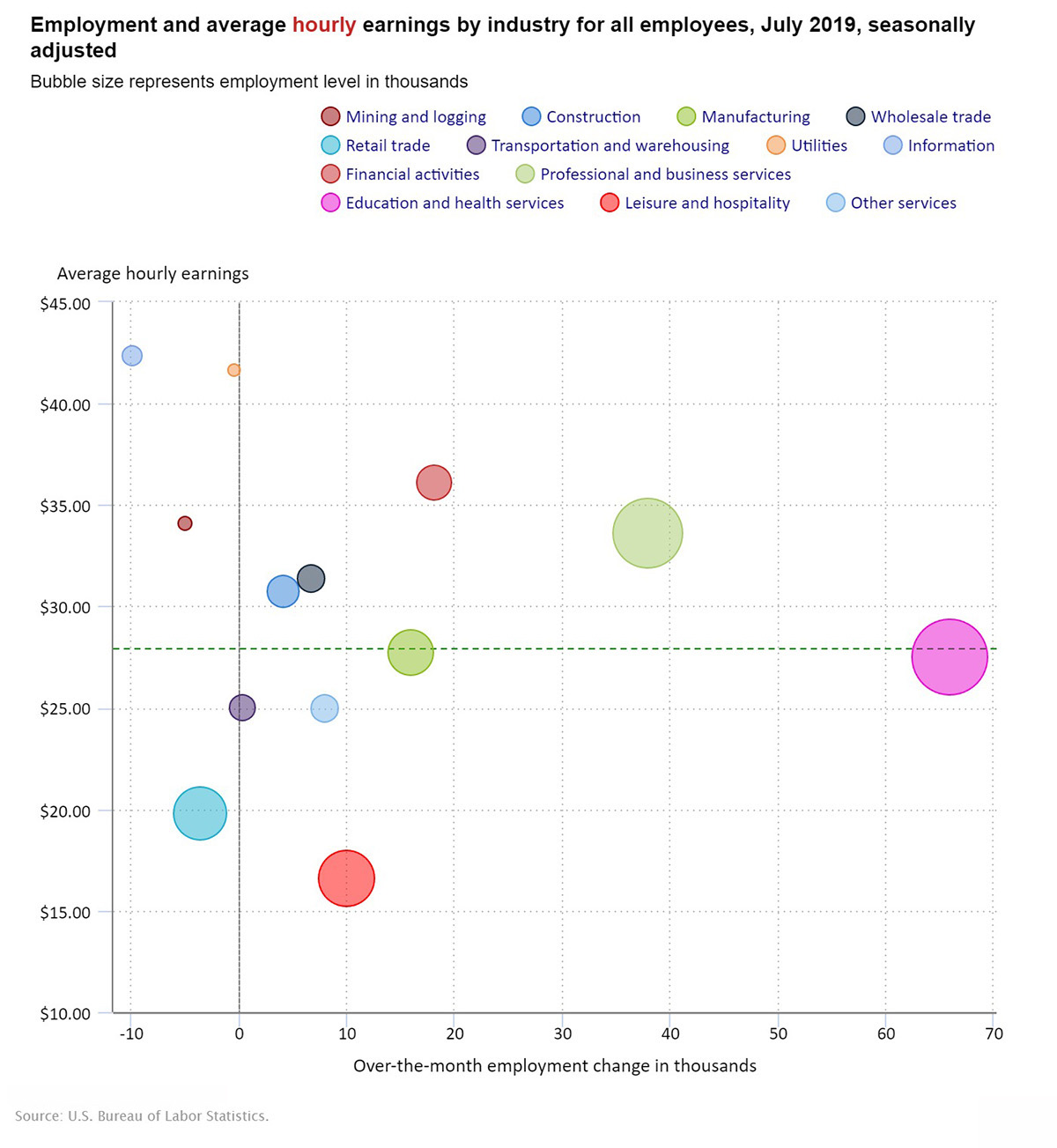

In the last twelve months, average hourly earnings are up 3.2% versus a 2.8% gain in the twelve months ending July 2018. In the chart below, you can see the average hourly earnings by industry. The top two industries by a number of jobs added last month are the Education and Health Services and Professional and Business Services industries. The majority of new jobs being created are in higher-paying fields which is encouraging news to those seeking employment.

Perhaps the best news about the labor market is that, in the past year, the fastest growth for usual weekly earnings has been at the lowest part of the income spectrum, with workers 90% down the income scale having wage gains of 6.2%. Those with less than a high school degree have experienced wage gains of 6.1% in the past year versus 3.2% gain for those with advanced degrees beyond college. In essence, on average those who earn the lowest wages are making the largest percentage gains. With the headline news switching back and forth from positive to negative every day in recent weeks (and sometimes even intraday), we prefer to focus on economic news. In the case of the American worker and the consumers who are driving our economy, the news is good.

Please contact us with any questions and we look forward to talking with you soon.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.