A Deeper Dive: Who wants to sell insurance?

by: Smith and Howard Wealth Management

In this quarter’s Deeper Dive, we discuss a strategy for investing that can be a valuable portfolio management tool: options. Options aren’t for everyone or every situation, but we do believe that used properly they can be an effective tool in many portfolios. In particular, there is one strategy we like to use when putting new dollars to work. Read more below.

First of all, what IS an option?

The definition from Investopedia is the clearest we’ve seen: “A stock option gives an investor the right, but not the obligation, to buy or sell a stock at an agreed upon price and date. There are two types of options: puts, which is a bet that a stock will fall, or calls, which is a bet that a stock will rise.” Options are also sometimes referred to as derivatives.

Options: from limited beginnings to exponential growth

The first publicly listed options on stocks occurred in 1973 when the Chicago Board of Options Exchange (CBOE) listed options on 16 stocks. In the 46 years since, options trading has experienced exponential growth from that small set of initial offerings and is now possible on thousands of securities, indices, asset classes and markets across the globe.

Even after 46 years, options remain intimidating and hard to understand for the vast majority of investors. This is understandable when one considers the increased complexity of options relative to investing in stocks. It is for that reason that we are very selective in how, when, or why we use or introduce options into a portfolio.

As your investment advisor, we take responsibility for understanding and executing portfolio strategies, but we also want to provide a basic understanding to investors who are interested in investment concepts. Our goal in this piece is to provide context through an illustration of one particular strategy that we have used on multiple occasions and which we think can be a valuable portfolio management tool under the right circumstances

When Options May be an “Option”

We often work with investors who have received a windfall from events such as the sale of a business or the receipt of an inheritance. Investing a large sum of new money can be challenging and scary for an investor. Advisors often suggest investing such large sums over a period of time rather than all at once (“dollar cost averaging”) as one way to calm investor fears of buying in at the top of the market. While we too use the dollar cost average approach, we’ve also deployed a strategy using options, with the goal of spreading investments over time and investing at a discount to prevailing market prices.

Being the Insurer Instead of the Insured

The options strategy we are referring to is often described as “selling insurance on the stock market”. Insurance may not be a perfect analogy, but it is a helpful way to think about the strategy, as investors are usually familiar with how insurance works: a buyer of insurance pays a premium or fee to protect from a specified risk – fire, flood, accident, etc… In the case of put options on a stock or the stock market, the same concept can be applied. Investors concerned about lower future stock prices can purchase insurance (for a fee or premium) in the form of what are called “put” options. Once owned, that put option gives the owner the right to sell or “put” their stock exposure to the seller of the insurance should the price of that stock or market fall below levels defined by the option contract (this level is called the “strike price”).

Purchasing insurance on the market seems like a reasonable or sound idea for a nervous investor. Unfortunately for investors it tends to be a “long term loser”, in that the premiums paid over time are likely to amount to more than the investor is able to save when markets fall. Markets spend more time moving sideways or higher than they do in falling, so most protection goes unused or in options parlance “expires worthless”. That is why it typically pays, both in the traditional insurance world and the options market, to be a seller of insurance and not a buyer. Fortunately, the options market allows an investor the ability to choose between being the insurance provider (seller) or the insurance buyer. In most scenarios, we prefer investors take the role of provider.

Illustrations

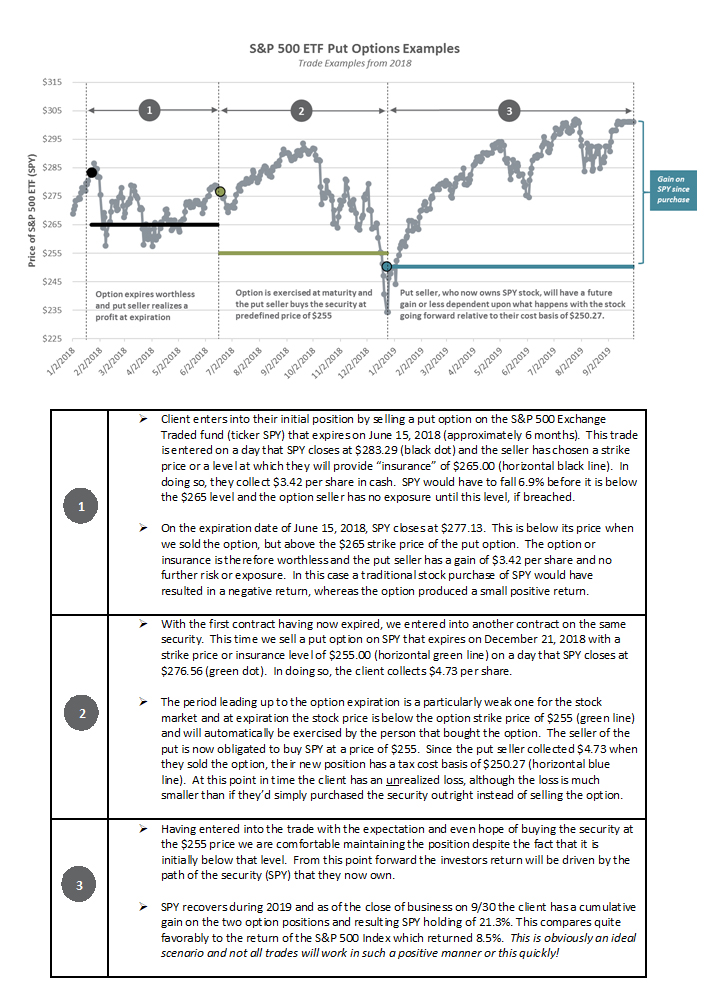

Options can be difficult to grasp without an example or seeing it play out in real life. In the graph and commentary below we will walk through two sample trades that we executed during the course of 2018 for a client. We should note that these were not the only option trades executed for this client, as additional options were sold on this security, as well as others. The two trades detailed below were chosen specifically to illustrate the two primary ways in which these options play out; 1) they expire worthless and the options put seller has a profit or 2) they are exercised and the options put seller is obligated to purchase the security at the predefined price. We enter into these transactions knowing we will be comfortable with either result, but thought it was important to illustrate how this may work in real life.

What We Look for as Investment Advisors

It is important to note that when we have employed this strategy we have a specific set of criteria that we look for.

This last bullet point is particularly important. While the options expiring worthless does mean we’ve made money, we ultimately do want to own the underlying security the option is written on. As we showed in our example, a purchase during a period of market stress or weakness can lead to lucrative gains when markets recover. Our long term goal is always to invest the funds; we just may prefer to do it at prices of our choosing.

We’re often asked why this strategy isn’t used by more advisors. Many simply lack the experience or understanding. In other cases, a firm’s business or portfolio structure makes it impractical or inefficient. Those are obviously poor reasons for why an investor isn’t able to use such a strategy and ones that we are happy to say do not limit our investment offerings at Smith and Howard Wealth Management.

If this is an approach or strategy you’d be interested in learning more about, please feel free to contact me, Brad Swinsburg, at 404-879-3132 or by email.

Explore more information on the third quarter of 2019 by visiting these links:

Market Recap: Third Quarter 2019

Market Outlook: Third Quarter 2019

On the Horizon: Third Quarter 2019

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.