The fourth quarter of 2025 delivered a fitting close to what ended up being a standout year for financial markets. While the final months were not without their moments of volatility, the overall trend remained positive – something that has been a theme since last spring. Equities again finished higher, supported by easing inflation pressures and a more accommodative Federal Reserve. Credit markets remained orderly, and diversification once again proved its value as areas other than U.S. stocks and bonds contributed in meaningful ways. There were certainly stronger three-month periods during the year, but the final quarter provided a solid finishing touch to an already impressive 2025 for investors.

Financial markets in 2025 are probably best viewed as two distinct time periods: the period leading up to and including the chaotic week following the April tariff announcements, and then the rest of the year. Early in the year, markets grappled with uncertainty as investors weighed the potential impact of new trade policies on inflation, growth, and corporate margins. The actual announcement of the new trade policy on April 2nd (dubbed Liberation Day) only amplified and added to those concerns. Market reaction was swift and decidedly negative.

Market instability ultimately forced the administration to put a “pause” on most of the new tariff policies. That pause, announced April 9th, de-escalated the situation and reduced the immediate fears of a global trade war. Even though the pause was temporary, the prospect of talks and potentially negotiated deals (particularly with China) significantly eased investor anxiety and markets quickly recovered. Uncertainty remained, but investors’ worst fears were eased and the timeline of consequences was delayed. April was a chaotic and volatile month, but incredibly it was also a profitable one and the start of a strong run for both stocks and bonds.

Equities

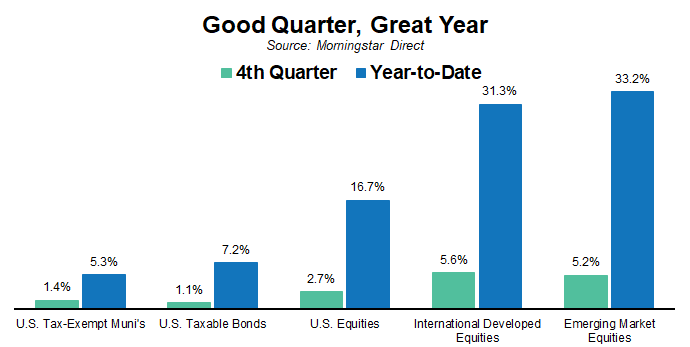

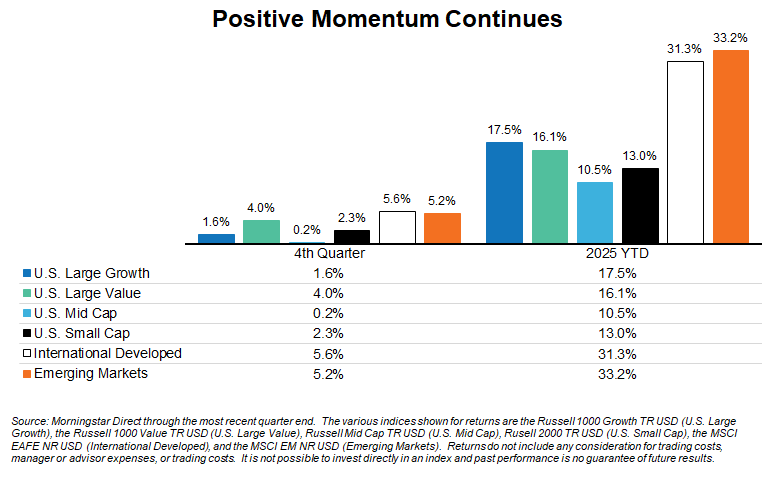

Equity markets delivered another solid, if not spectacular, quarter with broad-based gains. U.S. equities delivered gains for investors both for the quarter and the year, but international developed and emerging market stocks continued to stand out. The return differences were not as notable as earlier in the year, but positive momentum continued and again provided a nice boost to returns for investors that remained globally diversified. Within equities, the story for the year was clearly international stocks and they were again a topic of conversation for one of our quarterly videos.

U.S. Large Cap Value was also an outsized contributor to returns for the recent period which was notable given that it had been a relative underperformer through September. On a sector basis, U.S. Health Care stocks (+14.4%) significantly outperformed all other sectors. This also represented a good example of the cyclicality of returns as the sector was up only marginally prior to the fourth quarter. Returns for the quarter were led by impressive showings from Eli Lilly (+48.1%), Merck (+35.1%), and Intuitive Surgical (+28.9%).

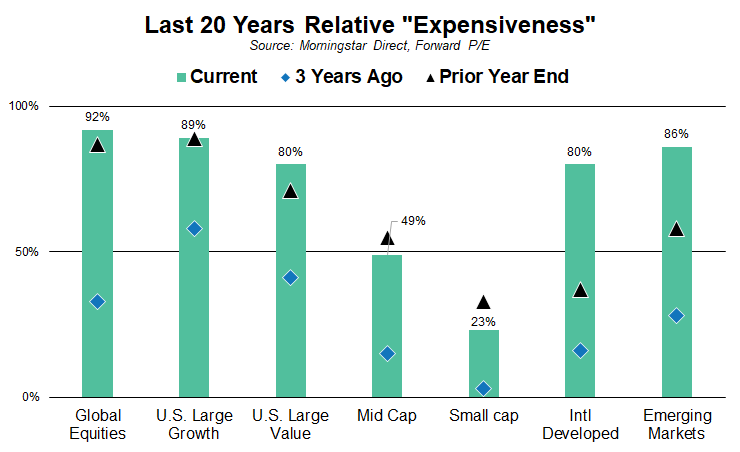

Looking ahead, our outlook for equity markets remains measured, shaped largely by where valuations stand today. While there are reasons to have optimism around corporate earnings and interest rates may continue to provide support, equity valuations appear relatively rich by historical standards. As the graph shows, current valuations for several market segments have rarely been more expensive over the last 20 years. For example, U.S. Large Cap Growth valuations, are at the 89% percentile – meaning that they have been more expensive only 11% of the time over the past 20 years.

An expensive market doesn’t mean prices can’t move higher, but it should temper return expectations and raise the bar for positive surprises.

Fixed Income

While returns lagged equities, bonds still posted positive performance for the quarter. Shifts in Federal Reserve policy rates and balance sheet dynamics often introduce volatility, yet investors largely looked through those factors for a second consecutive quarter. Strength in equity markets often leads investors to question their bond allocations, but bonds continued to play a constructive and additive role in portfolios. Returns were generally in-line with yield levels for the quarter, but on a year-to-date basis, most segments outperformed their beginning-of-year yield-to-maturity levels.

Interestingly, similar to global equities, international opportunities generated outsized returns. Emerging market debt was the standout both for the quarter and for the year.

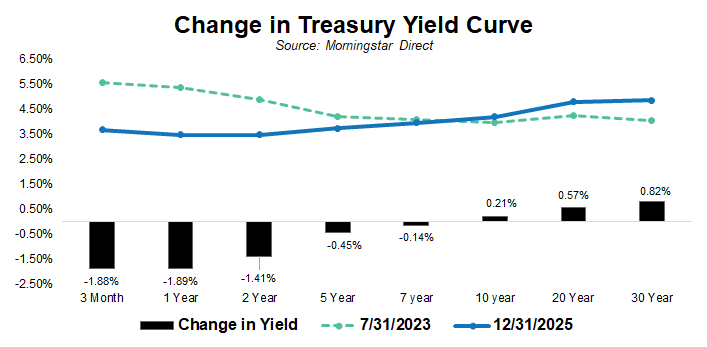

While yields along the yield curve generally fell during 2025, the more interesting contrast or comparison would be to compare current yields to the end of July 2023, just after the Fed’s last interest rate hike. With the Fed now further along in its easing cycle, we can see just how far short-term rates have already dropped. It may surprise some, but the longer end of the curve has actually risen a bit and the curve is now more normally shaped or upward sloping.

Those changes mean that relative to the summer of 2023, cash is much less attractive while intermediate and long-term bonds are slightly more attractive – from a starting point yield perspective. As we’ve said several times over the past few years, bonds aren’t necessarily “cheap”, but we also wouldn’t characterize them as expensive. One area within fixed income that we do believe is expensive is lower credit quality strategies, like corporate high yield, where credit spreads remain tight (low).

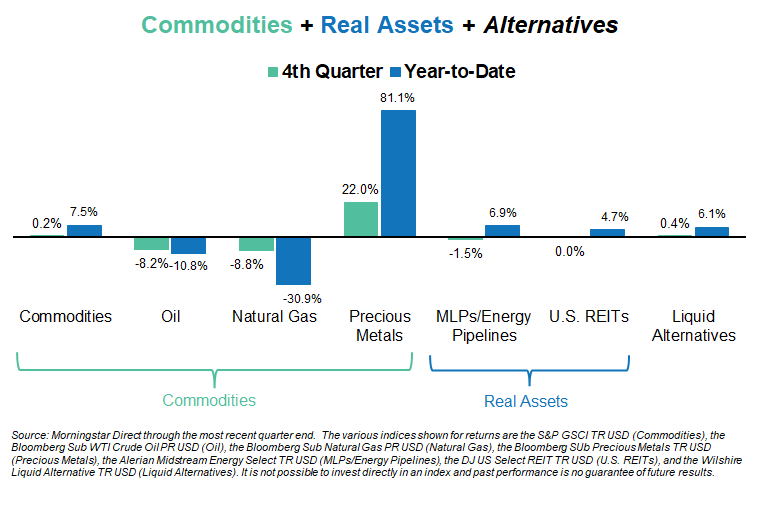

Commodities + Real Assets + Alternatives

Precious metals were again the story outside of traditional stocks and bonds. Gold is the predominant component of precious metals indices, but strength within the index was not solely due to gold (+12.8). In fact, silver (+49.8%) and platinum (+24.6) surged during the quarter as investors went in search of opportunities beyond gold.

Returns beyond precious metals were mixed and unremarkable, although natural gas and oil did experience notable declines.

For clarification purposes, please note that our listing of commodities, real assets, alternatives and returns for the period shown is far from an exhaustive list. We’ve chosen to show broad indices or specific strategies because they tend to be areas of interest for investors and/or areas that we own in client portfolios.

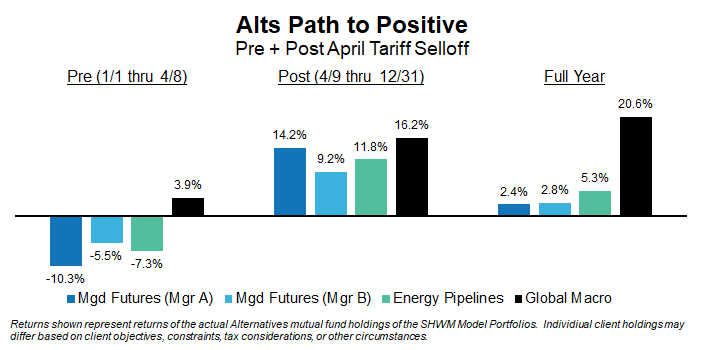

As we noted in our Market Overview, returns in 2025 can be viewed as unfolding in two distinct phases: a challenging start followed by a powerful recovery. That pattern held true for our favored alternatives strategies, as well. Those markets and strategies did take longer to recover than either stocks or bonds, but they each ultimately navigated the year profitably.

Back to Insights

Back to Insights