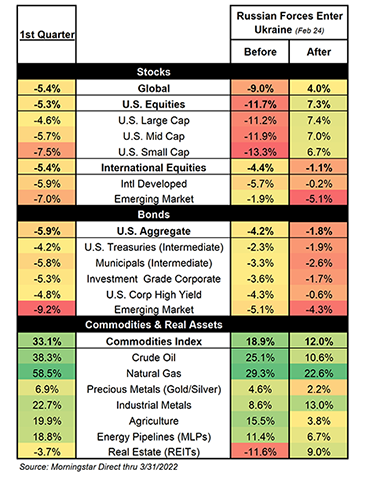

After a strong close to 2021, investors encountered a more challenging environment in the first quarter of 2022. While many may think that any difficulties were the result of the ongoing and unfortunate conflict between Russia and Ukraine, it was only part of the story. A quick glance at returns for the quarter, and specifically the columns on the far right of our table, show that while the conflict certainly impacted markets, it wasn’t the only driver and may not have been the most impactful. Stocks were weaker before the conflict escalated and U.S. stocks, in particular, did quite well after that point. Bonds, often a safe haven for investors during geopolitical conflicts, fell both before and after Russian forces entered Ukraine.

Inflation, which also preceded fighting in Ukraine, was the other issue investors couldn’t ignore. Persistent inflationary pressures appeared to finally have forced the Federal Reserve to take a more aggressive interest rate policy approach. While some Fed activity had been expected during 2022, more recent data and Fed communications made clear that they would be acting sooner and in larger increments than previously anticipated. That shift in expectations weighed heavily on both stocks and bonds throughout the quarter.

Equities

Given concerns entering the year about valuations and inflation, it may have been disappointing but not surprising that equities had negative returns for the quarter. What may be surprising to investors is the path that some markets took during the quarter and the impact that the Russian invasion of Ukraine had, particularly with respect to U.S. equities. Prior to February 24th, the day Russian forces entered Ukraine, U.S. equities were decidedly negative and had even entered correction territory (down more than 10% from a previous high). International developed markets were also negative but modestly so. Emerging markets (of which Russia and Ukraine are considered part) had fared the best and were even positive until just a few days before fighting commenced.

The story of which markets were out or underperforming began to change almost immediately after Russian troops crossed the border. It’s not surprising that emerging markets went from outperformer to underperformer given the circumstances, but it is notable that from that point forward, U.S. equities rallied and international developed stocks were close to flat. The late surge in U.S. equities helped erase more than half of the losses sustained early in the quarter.

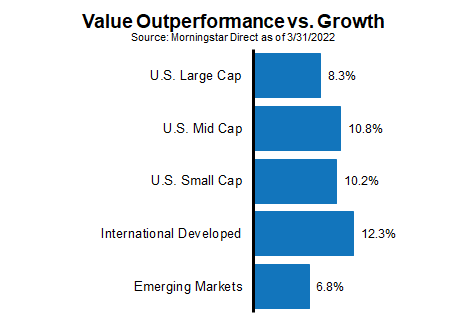

There was another notable outperforming area during the quarter, and that was in value stocks. Value stocks’ outperformance relative to growth stocks was not only meaningful in percentage terms, but also broad based across market capitalizations and geographies. The relative gains were particularly impressive given 1) the magnitude of the outperformance over such a short time-period and 2) the fact that value had also outperformed in 2021. Equities may have been down overall, but that was primarily driven by weak performance in growth stocks and growth sectors, such as technology and consumer discretion.

Investors curious in regard to what we mean by value and growth stocks, value stocks tend to be well established businesses, with consistent earnings and often paying nice dividends. The largest value companies in the U.S., for example, are Berkshire Hathaway, J.P. Morgan, Johnson & Johnson, UnitedHealth, and Proctor & Gamble. Growth companies tend to be companies that are expected to experience high levels of growth in revenues, but that growth may come with less consistency, predictability, or even profitability. Stocks like Apple, Microsoft, Amazon, Tesla, and Facebook (now Meta Platforms) all would fall into that category.

As we’ve noted before, the bright side of negative returns or lower prices for stocks (and bonds) is that it generally improves the outlook going forward. With lower prices and earnings remaining solid, valuations and our long-term forward-looking outlook improved. As valuation-focused investors that try to look past short-term cyclicality and geopolitical events, that is always encouraging. Last quarter we mentioned that changes in interest rates can have a material impact on returns. Despite the conflict in Ukraine, we attribute much of the weakness during the recent quarter to in the increase in interest rates. For more on our thoughts related to interest rates, please watch this short video segment.

Fixed Income

For the second consecutive year, the first few months of a new year brought negative results for fixed income investors. Unfortunately, the loss in early 2022 (-5.9%) is materially larger than the one experienced during the first quarter of 2021. In fact, the recent results marked the largest quarterly loss for the index since 1980.

Our video segment on interest rates and inflation highlights reasons to believe that the worst may be over in bonds and that 2022 could look a lot like 2021 – a tough first quarter followed by better returns during the remainder of the year. Expecting bonds to generate positive returns for the calendar year may be a tall task, but it wouldn’t be surprising to see some recovery given that current bond pricing and yields have already adjusted or built-in what they think the Fed is likely to do in 2022 (remember, markets are anticipatory and price things in before they actually happen).

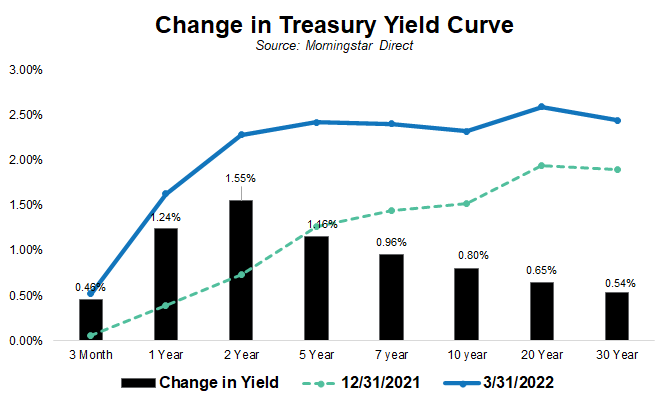

As with equities, lower bond prices, which go hand-in-hand with higher yields, improve the return outlook going forward. Yields are still low by historical standards, but as our yield curve graphic (“Change in Treasury Yield Curve”) shows, the move this past quarter was significant. It was clearly most significant in the shorter maturity portion of the U.S. Treasury curve which highlights just how much investor expectations changed in regard to Fed rate hikes. The collective market went from expecting two to nearly 10 possible rate hikes in just three months! That shift obviously had a negative impact on returns in the recent quarter, but it’s welcome news to those hoping to earn something on their cash and advantageous for bond returns going forward.

Commodities + Real Assets

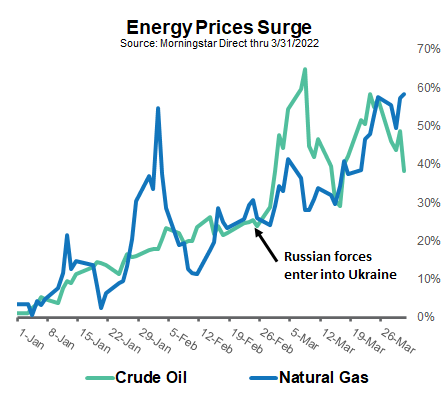

Commodities charted a very different course than either equities or bonds during the quarter. Unlike those two asset classes (which make up most investment portfolios), commodities experienced positive price movement throughout the quarter. Some commodities were obviously stronger than others, but most major commodity markets saw sizeable gains both before and after the start of fighting in Ukraine. Fighting there and the resulting economic sanctions placed on Russia only served to further fuel global inflation concerns that were already pushing up commodity prices.

The sharpest upward moves were seen in natural gas and oil markets. Both experienced large moves and significant price volatility during the quarter. This increase in price and volatility was not a surprise given European reliance on Russia for both commodities. For context, the European Union (the EU) gets roughly 40% of its gas from Russia and over a quarter of its imported crude oil.

The lone exception to positive price movement for the category during the quarter was in U.S. Real Estate Investment Trusts (REITs). In our table of returns at the beginning of this article, we group REITs and Energy Pipelines (MLPs) in with commodity markets due to their “real asset” nature and in the case of MLPs their close association with oil and gas. Energy Pipelines benefitted from that close association this past quarter, but REITs fell modestly. While REIT industry proponents have pointed to them in recent years as being inflation resistant and not impacted by rising interest rates, that perception still exists and likely weighed on recent results.

Despite the strong recent returns across commodity markets we continue to caution investors against allocating to them purely as an inflation hedge. They may prove to be an effective hedge again during this cycle, but we can’t assume history will always repeat itself. Commodities are notoriously volatile and investing in them is neither as simple or straightforward as investing in stocks and bonds. Our preference is typically to own stakes in companies involved in the commodity supply chain that benefit from the upward price movement of a commodity but aren’t necessarily reliant on it. Our investment in the Energy Pipelines space is one example of that approach. We like their consistent cash flows and reasonable valuations, and while the recent surge in the price of the commodities they transport helps, it’s not the reason we own them.

Questions + Additional Information

As always, our team of advisors is available and ready to answer your questions on these or other topics related to investments and financial planning. Please call us at 404-874-6244 or email us here.

For additional information on how inflation and the crisis between Russia and Ukraine are affecting the global economy, watch these video segments from Smith and Howard Wealth Management’s Chief Investment Officer, Brad Swinsburg.

Back to Insights

Back to Insights